Home

Terms and Conditions

Market Highlights: Sensex ends nearly 190 points and Nifty 50 below 18,100

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on January 19, 2023. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Share Market Update | Ambit's Nitin Bhasin's view on market

"Perhaps in the next three months, there would be more volatility in the market. Though, in the beginning of the year, when we wrote the note about how do we look at the market, we think there's a fair valuation of an eight to 10 percent upside, if one was to think for the year. But the next three months to six months, we're going to see one of the big changes in the Indian market which is the domestic flows, whilst earnings have an impact on a near-term basis. But the last year, what we also saw as the FIIs were perhaps selling in the first half the domestics throughout the year, especially the flows, held strong. And what we are noticing now is beginning of some sort of softness in the flows from the domestic market, especially because either the last 12 months returns of the market or secondly, in the rising interest rates in the deposits are impacting. As we go through this earnings season and as we go through this shift in the DII flows that would create volatility at least for the next three months. And add to it, what's happening into the US, the entire talk about recession perhaps in the US or the other developed market. So volatility will remain high," Nitin Bhasin, Head-Equity Research, Ambit.

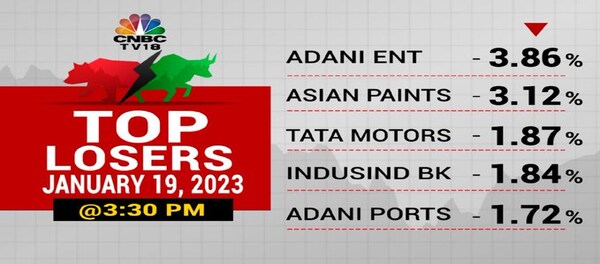

Market at Close | Sensex and Nifty 50 closes with minor cuts after a rangebound session

-- Asian Paints erases gains to close two percent lower on below-than-expected December quarter.

-- Adani Ent continues its downward trend, ends four percent lower on FPO price.

-- IndusInd slips two percent after reporting a mixed set of earnings.

-- Persistent surges eight percent on strong commentary, Polycab up two percent on healthy December quarter.

-- Havells recovers to end with minor gains after an improved set of earnings

-- ICICI Lombard for second straight day on lower-than-expected December quarter, stock down three percent.

-- Indigo rises two percent and Spicejet over one percent following healthy aviation data.

-- Torrent Power, Indiabulls Hsg, RBL Bank, Manappuram are top midcap losers.

-- Exide, Honeywell, Vedanta, Voda Idea are top midcap gainers.

-- Market breadth favours declines, advance-decline ratio at 2:3

Rupee at Close | Rupee ends lower at 81.36 vs dollar

Share Market News | State Bank of India invites proposals from companies to partner with on YONO 2.0

SBI's YONO 2.0 app, would be a digital bank that would offer various services and products under one platform, including mutual funds, credit card, insurance. The YONO 2.0 app would be available to everyone, and not just limited to customers of India's largest lender. (Read more)

Stock Market News | Polycab reports December quarter earnings

-- Net profit up 45.1 percent at Rs 358 crore vs Rs 246.7 crore year-on-year

-- Revenue up 10.2 percent at Rs 3,715.1 crore vs Rs 3,372 crore year-on-year

-- EBITDA up 39.3 percent at Rs 503.7 crore vs Rs 361.7 crore year-on-year

-- EBITDA margin at 13.6 percent vs 10.7 percent year-on-year

Share Market Update | Expectation from the banking space is that this would be the single most sector which will drive the earnings growth for corporate India in Q3: Siddhartha Khemka

"From a long-term perspective, we are positive on IT. The top picks we are recommending from the IT space are Infosys, TCS, HCL Tech. Coming to banking, I think results so far have been strong. HDFC Bank, IndusInd, and some of the smaller banks like Federal Bank. Overall, the expectation from the banking space is that this would be the single most sector which will drive the earnings growth for corporate India in Q3 and led by some of the PSU banks where the delta is even higher. So, overall, banking would continue to do well. Axis Bank is another where valuations are still comfortable, and we are expecting good numbers. The stock has corrected in the recent past. We see good upside on this apart from the usual heavyweights, the ICICI, SBI and HDFC of the world," says Siddhartha Khemka, Head-Retail Research, Motilal Oswal Financial Services.

Stock Market News | UBS downgrades Titan, sees no further upside potential in stock

UBS said that Titan has been downgraded as weak jewellery demand in the fiscal year 2024 is likely to impact the company’s growth. (Read more)

Share Market News | Havells reports December quarter earnings

Here's how the numbers fared compared to CNBC-TV18 poll and previous year:

| Q3FY23 | vs CNBC-TV18 Poll | vs Q3FY22 | |

| Profit | Rs 284 crore | +10.1% | -7.2% |

| Revenue | Rs 4,120 crore | +1.6% | +12.8% |

| EBITDA | Rs 424 crore | +11.9% | -3.8% |

| Margin | 10.3% | +100 bps | -180 bps |

Share Market Live | Goa Carbon shares rise after December quarter revenue nearly doubles

Revenue from operations jumped by a whopping 93 percent to Rs 416.8 crore compared to Rs 216.1 crore in the year-ago quarter. (Read more)

Share Market Live | Asian Paints reports December quarter earnings

-- Net profit at Rs 1,097 crore vs CNBC-TV18 poll of Rs 1,145 crore

Here's how other numbers fared vs the CNBC-TV18 poll:

| Q3FY23 | CNBC-TV18 Poll | Vs Estimates | |

| Profit (Rs crore) | 1,097 | 1,145 | - 4.2% |

| Revenue (Rs crore) | 8,608 | 9,510 | - 9.5% |

| EBITDA (Rs crore) | 1,611.6 | 1,710 | - 5.8% |

| Margin | 18.4% | 18% | 40 bps |

Share Market News | Asia likely to capitalise on weakness in Europe and US markets with China, India leading the way

Herald Van Der Linde, Head-Asia Equity Strategy at HSBC, believes now is the time to be invested in Asia, and particularly in China and India. As these two countries are expected to be the fastest growing markets in 2023, companies with domestic exposure in India are worth looking at. (Read more)

Stock Market News | Alembic Pharma receives tentative approval from US drug regulator for Acalabrutinib Capsules

-- Received tentative approval from the US Food & Drug Administration for its Abbreviated New Drug Application (ANDA), Acalabrutinib Capsules, 100 mg.

-- Therapeutically equivalent to the reference listed drug product (RLD), Calquence Capsules, 100 mg, of AstraZeneca UK Limited (AstraZeneca).

-- Indicated for the treatment of adult patients with mantle cell lymphoma (MCL) who have received at least one prior therapy and treatment of adult patients with chronic lymphocytic leukemia (CLL) or small lymphocytic lymphoma (SLL).

-- Estimated market size of US$1.5billion for twelve months ending Sep 2022 according to IQVIA.

-- Cumulative total of 180 ANDA approvals (157 final approvals and 23 tentative approvals) from USFDA.

Stock Market News | ICICI Securities reports December quarter earnings

-- Net profit down 26.6 percent at Rs 279.1 crore vs Rs 380.2 crore year-on-year

-- Revenue down 6.7 percent at Rs 878.8 crore vs Rs 941.6 crore year-on-year

-- EBITDA down 10 percent at Rs 548 crore vs Rs 608 crore year-on-year

-- EBITDA margin at 62.3 percent vs 64.6 percent year-on-year

Steel Earnings Preview | Operating profit per tonne may improve after four quarters

EBITDA per tonne for Tata Steel's European business is likely to be a loss, due to a significant drop in prices and weak demand, resulting in an adverse product mix. (Read more)

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|