Home

Terms and Conditions

Stock Market Highlights: Sensex ends 274 pts higher and Nifty above 18,200 led by Infosys, Reliance and TCS

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on November 22, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Incremental position or fresh positions for ICICI Bank and SBI not sensible at this point: Jai Bala

"The banking stocks, the heavyweights, ICICI Bank and State Bank of India both look like they have an incomplete structure in the recent highs. So probably they still have fresh 52-week highs to clock. ICICI above Rs 943 and SBI above Rs 621. But incremental position or fresh positions may not be sensible at this point. But if you if you are already holding the stocks, use a trailing stop and stay within the trend here," says Jai Bala, Cashthechaos.com.

Sensex and Nifty end higher halting 3-day losing streak

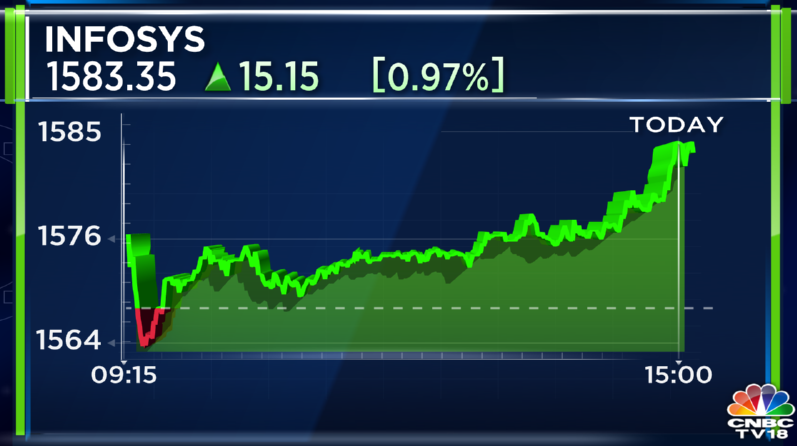

-- IT stocks see a recovery in late hours with Nifty IT gaining two percent from lows

-- Infosys, RIL, TCS and ITC lift market while HDFC Bank, Kotak and Bharti drag

-- ICICI Bank and IndusInd Bank are top contributors to Nifty Bank

-- HAL rises three percent after company revises FY23 margin guidance to 26-27 percent from 24-25 percent

-- PSU Banks continue the gaining momentum, BOB up three percent, UCO Bank up 12 percent

-- Metropolis recovers from lows as company sees no business impact from I-T search

-- Gail gains two percent while GSPL slips from highs after PNGRB’s tariff policy notification

-- Shriram Trans, GNFC, BHEL, Glenmark, Rain Industries, Dalmia Bharat top midcap gainers

-- MGL, IEX, Intellect, Birlasoft, IGL, HPCL are top midcap losers

-- Max fin fails to hold gains seen after an exchange of 1.5 percent eq, stock down two percent

-- Kaynes Tech makes a strong debut, closes at Rs 685 vs issue price of Rs 587

-- Selling in new-age companies continue, Paytm down 11 percent, Nykaa slips five percent

-- Market breadth favours declines, NSE advance-decline ratio of 4:5

Bullish on navy and air force: Ravi Dharamshi

"Within defense, we are very bullish on navy and air force. And these are the two service arms of the government which are going to spend more than $1 than what is going to be allocated to them in the budget," says Ravi Dharamshi, CIO of ValueQuest Investment Advisors. "There are very few players that can address that kind of opportunity. The private sector is for all purpose till date nonexistent. But for the next 10 years, it's going to be the public sector defense companies that are going to make the most of the opportunity that lies ahead of us."

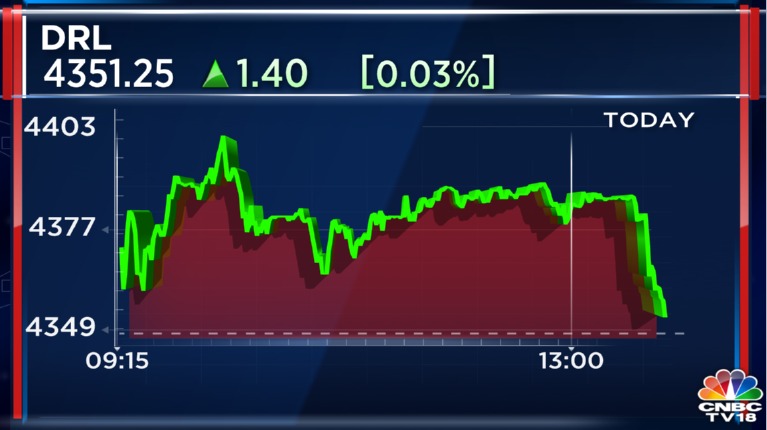

On IT and Pharma, Dharamshi said, "We continue to stick with the conscious view and I will tell you where the view is flowing from. We do have a negative view of what's happening in the world. Unfortunately, or it is negative for the outward facing sectors like IT and pharma. There are of course, other challenges that the sector has faced for example, pharma, there is a huge consolidation of buyers. So, there is a structural shift of bargaining powers towards the buyers as against the manufacturer of the product. So, Pharma is facing a constant challenge of reduction pricing going forward." According to Dharamshi, "near term headwinds in the IT sector remains with the kind of churn that we are seeing at the headcount level, the demand is slowing down, there are layoffs happening in US, US market overall is slowing down. So it's prudent to be watchful from the next one or two quarters point of view, let them correct a little bit more and at that point of time one can reevaluate it again."

Remain structurally constructive on the telecom space: Satish Ramanathan

“Telecom has consolidated significantly and we can see it happening in our personal experience as well that there are very few options in the telecom space for operators and its either Airtel, Vodafone or Jio. So when this kind of a structural consolidation takes place, it's a matter of time before tariffs start nudging up as we get better profitability. Also in terms of capital efficiency, we see the telecom space becoming more efficient once they move to 5G," says Satish Ramanathan, CIO-Equity, JM Financial Asset Management.

"We remain structurally constructive on the telecom space. But that said, it's still a utility, it still has government’s caveat coming in in terms of pricing, in terms of spectrum, things of that sort, so we have to play it accordingly,” Ramanathan said.

Disclosure: RIL, the promoter of Reliance Jio, also controls Network18, the parent company of CNBCTV18.com.

Buy Britannia, Dalmia Bharat: Aditya Agarwala

Here are two recommendations by Aditya Agarwala, Head-Research & Investments at Invest4edu

-- Buy Britannia for a target of Rs 4,250-4,300 with a stop loss at Rs 4,100

-- Buy Dalmia Bharat for a target of Rs 1,800 with a stop loss at Rs 1,675

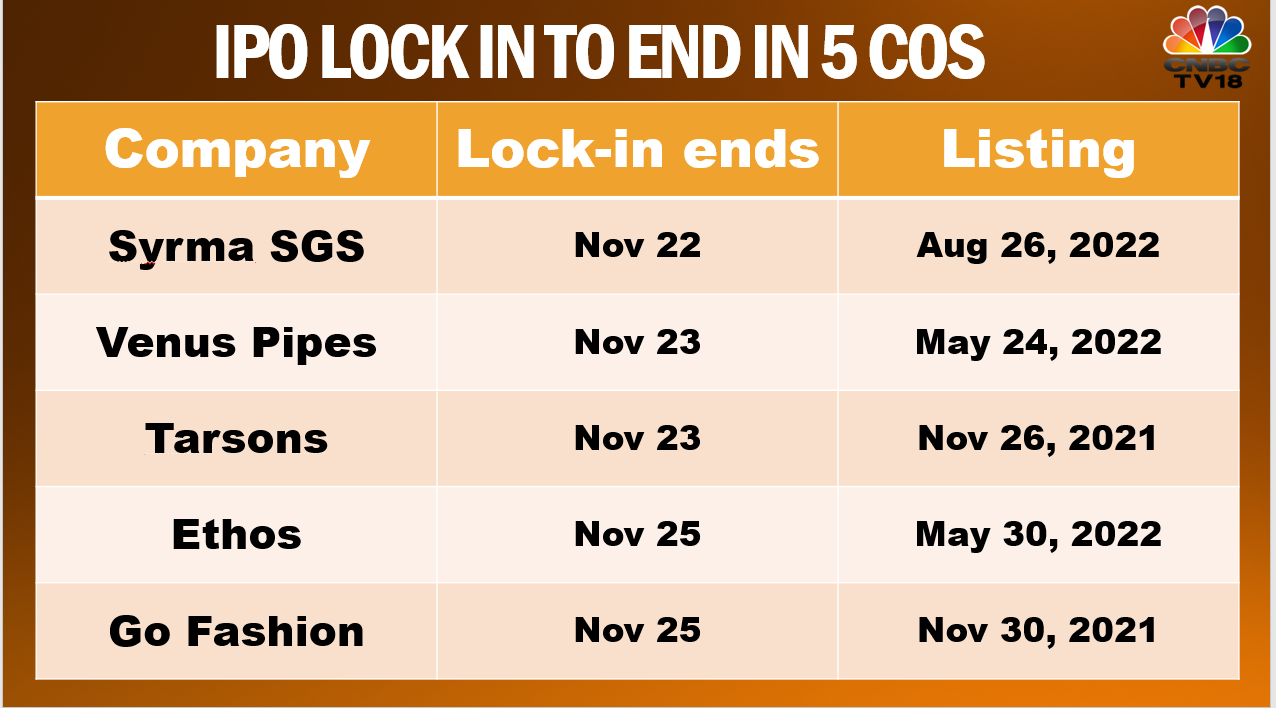

Lock-in period for 5 IPOs ends this week

| Stock | CMP vs issue price | CMP | Issue price |

| Syrma SGS | +31.5% | 289.25 | 220 |

| Venus Pipes | +116.1% | 704.55 | 326 |

| Tarsons | +5.1% | 696.05 | 662 |

| Ethos | +1.1% | 887.35 | 878 |

| Go Fashion | +70.3% | 1175.1 | 690 |

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|