Home

Terms and Conditions

Stock Market Highlights: Sensex and Nifty50 scale 4-month closing highs — rupee slips to 79.64 vs dollar

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on August 11, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Earnings and economic momentum to drive Indian market in near term: Rupen Rajguru

Rupen Rajguru, Head-Equity Investment and Strategy at Julius Baer, tells CNBC-TV18 that in his view, the earnings and economic momentum will drive the Indian market. "From an India perspective, one thing that is very clearly emerging out of this entire 10 months of huge volatility is that India is a standout market. I think the one reason for that is earnings," he says.

"Short-term momentum in the markets can definitely take us higher, but as we were extremely bearish a month back, probably now we are getting into that if not extreme bullish... No good amount of bullishness right now, so this pendulum can swing anytime," he adds.

Market At Close | Sensex and Nifty50 at 4-month closing highs

Here are some highlights:

--Headline indices rise in 7 of 8 trading sessions so far this month

--Financial stocks support headline indices — Axis, Bajaj Finance, HDFC and SBI top gainers

--Tata Consumer top Nifty loser after in line earnings

--Apollo Hospitals slips two percent ahead of results

--City gas distribution stocks surge on government's decision on contribution

--Cummins jumps six percent on positive management commentary post-earnings

--Zydus Life reports better-than-expected quarterly performance — stock rises five percent

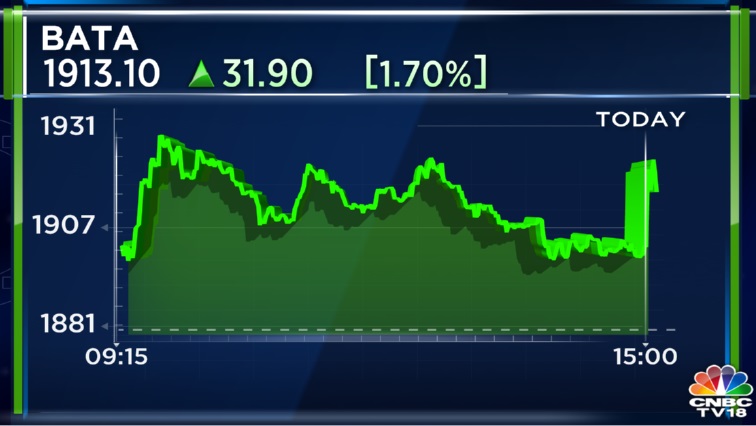

--Bharat Forge, Bata and Trent rise after results

--Abbott top midcap loser as earnings miss Street expectations

--NBCC, PVR, GNFC, IOC, ICICI Prudential and Metropolis top midcap losers

--Market breadth neutral — advance-decline ratio at 1:1

Bata quarterly profit misses Street estimates

Bata reports a net profit of Rs 119.3 crore for the April-June period, as against a net loss of Rs 69.5 crore for the corresponding period a year ago. Its revenue jumped 3.5 times on a year-on-year basis to Rs 943 crore for the three-month period, according to a regulatory filing.

Analysts in a CNBC-TV18 poll had estimated the company's net profit at Rs 148 crore and revenue at Rs 977 crore.

Bharat Earth Movers shares jump

We expect stable performance in Q2: Kalyani

Kalyani, Bharat Forge, said, "Looking ahead into Q2, we expect stable performance." "Expect stable performance in both domestic and export markets European operations have delivered a stable performance as per plan," Kalyani added.

Buy Jubilant Foodworks, Canara Bank: Sudeep Shah of SBI Securities

-- Buy Jubilant Foodworks for a target of Rs 615-620 with a stop loss at Rs 573

-- Buy Canara Bank for a target of Rs 245-250 with a stop loss at Rs 224

Buy Jubilant Foodworks, Piramal Enterprises: Himanshu Gupta

Here are two recommendations by Himanshu Gupta, Vice-President Research at Globe Capital:

-- Buy Jubilant Foodworks for a target of Rs 615-620 with a stop loss at Rs 582

-- Buy Piramal Enterprises Ltd for a target of Rs 1,980-2,000 with a stop loss at Rs 1,890

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|