Home

Terms and Conditions

Stock Market Highlights: Sensex ends 518 pts lower and Nifty below 18,200 dragged by financial and IT shares

Live Updates

Thank you, readers! That's all from CNBCTV18.com's live market coverage on November 21, 2022. Stay tuned for other updates on our website: CNBCTV18.com.

You can follow us on Twitter: @CNBCTV18Live @CNBCTV18News

And on Facebook, LinkedIn, Instagram and Telegram

Download our mobile app for Android and iOS platforms

Aggressive investors willing to put money in the banking space can buy PNB: Sudip Bandopadhyay

“SBI was always talked about but other PSU banks were really putting at a significantly lower valuation. Now at this stage, Bank of Baroda, Canara Bank have seen rallies, moved up a bit," says Sudip Bandopadhyay, Group Chairman at Inditrade Capital. "One PSU bank which has not come up with good set of numbers and still are lagging the other large PSU Banks has been Punjab National Bank. If somebody is a little aggressive investor, I would recommend to buy PNB. Yes, there has been challenges with this bank continuously over the last few years, last quarter also, Q2, was nothing great, but they will turn the tide and whether it's Q3 or Q4, they will come back with a decent set of numbers, which probably will beat all of us, our expectations."

ICICI Bank has been the best performing stock, HDFC will be interesting to look at: Aman Chowhan

"ICICI Bank has been the best performing stock and people are starting to look beyond ICICI which is now consensus trade and look at relative valuation. So the number three player or the number four player is almost 20-25 percent discount to ICICI that makes it interesting," says Aman Chowhan, Fund Manager at Abakkus Asset Management. "Specific to HDFC in almost two years, the stock has been zero return, the overall merger hanger over is now behind us. I think, what the next three to six months HDFC will be interesting to look at, because this time correction, the three to four times book, which was the valuation premium HDFC had has now come off and it's just a matter of time and it will start trading again at a premium once the base effect wanes off and the growth picks up."

Here on the growth rate for the HCL Tech should track larger peer group: Aman Chowhan

"HCL Tech is a decent combination for us. It's a good value as well as growth stock. There was an interim time when they had the big large product acquisition and which dragged overall margins as well as the growth profile for the company," says Aman Chowhan, Fund Manager at Abakkus Asset Management. "Now most of that is in the base. So from here on the growth rate for the HCL Tech should also track the larger peer group. Once that happens, the 30-35 percent valuation discount that we have versus the larger player should narrow. So that's the narrative we have on HCL Tech and lower risk and decent reward option for us versus the peer group that we have in the IT space."

Market closes in the red for third straight day

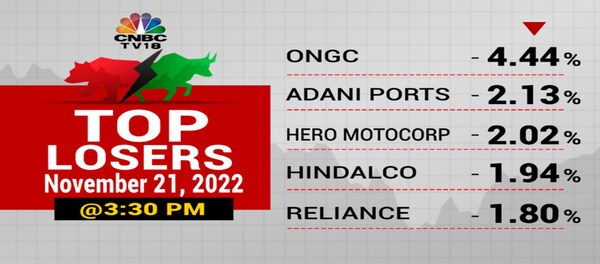

-- Upstream oil companies slip while downstream companies rise on fall in crude prices

-- ONGC is top nifty loser with a cut of five percent while BPCL rises two percent to be top gainer

-- Bharti Airtel discontinues 99 entry level plan in two circles, stock up two percent to record high

-- Escorts kubota surges eight percent to record high after company’s mid-term business plan guidance

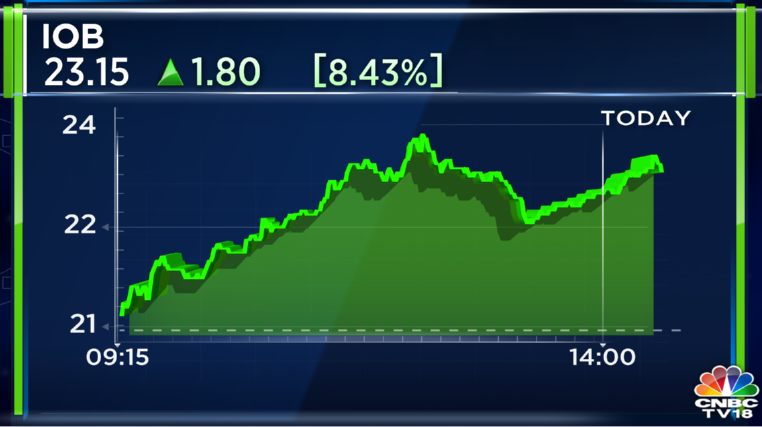

-- PSU banks continue the gaining momentum, PNB up four percent, UCO Bank up 20 percent and BOM up 15 percent

-- Aarti Ind gains more than two percent after 20-yr agreement with Deepak Fert for nitric acid

-- IEX moves five percent higher as company plans to consider buyback in November 25 board meet

-- TVS Motor, Jubilant Food, L&T Infotech, Bandhan Bank are top midcap losers

-- Shriram Trans, NMDC, GNFC, HPCL, Torrent Power amongst top midcap gainers

-- Market breadth favours declines, advance-decline ratio at 1:2

Zomato relatively better placed though not very comfortable taking a longer term view: Hemang Jani

“High profile exit in any start-up and platform company is not a new phenomenon. I don't think the market is going to get perturbed by that and when we compare Zomato with some of the other new age IT companies be it Paytm or Policybazaar; Zomato relatively in terms of performance and the potential is better placed also a large part of the selling, which was there, has also got absorbed and post that the stock has seen a decent amount of uptick," says Hemang Jani, Motilal Oswal Fin Services. "So, we think that it is relatively better placed though we would not be very comfortable taking a longer term view, but given the quarterly performances on many operating parameters, we think that this provides a good opportunity for retail traders who are looking for a 10-15 percent kind of a move, so this is definitely a preferred one.”

Short term orientation for most people: Prakash Diwan

"The roadmap that you see is exactly what a Japanese player would think like. That's exactly why Kubota is in, they've taken time to settle in, to get their feet into the business and the market. And now they're very clearly looking at the segments where they would get into a little bit of a leadership mode in the next year, two, three years," says market expert Prakash Diwan. "I think it's a great business model that's emerging, it's a great product profile at least that is emerging, but you will have to buy it on dips and the market will give you dips in the auto side on any particular day where there's some sort of news flow that probably is not so strong. And that's exactly when you buy," Diwan adds.

Buy Axis Bank, Hindustan Aeronautics: Himanshu Gupta

Here are two recommendations by Himanshu Gupta, VP Research at Globe Capital:

-- Buy Axis Bank for a target of Rs 885-890 with a stop loss at Rs 858

-- Buy Hindustan Aeronautics Ltd (HAL) for a target of Rs 2,720-2,750 with a stop loss at Rs 2,620

Company very strong in mass segment with Officer’s Choice: Allied Blenders' Bikram Basu

Bikram Basu of Allied Blenders tells CNBC-TV18 that around Rs 700 crore of the IPO proceeds of Rs 1,000 crore (fresh issuance) will go towards repayment of debt. The remaining Rs 300 crore will go towards capacity expansion and brand building, he adds.

Near term earnings estimate is slowing down, need to be cautious: Jigar Mistry

"Banking clearly was one that was shining, industrials was one where we saw a beat, healthcare was other where we saw a small beat. But it was predominantly driven by financials and industrials which grew almost 50 and 28 percent respectively," says Jigar Mistry, Co-Founder, Buoyant Capital. "A few brokerages have released their report stating that they are cutting the next year earnings by about 3 or 4 percent, although boosting up the next calendar year earning. But the far out earnings, we have known to be very, very hunky dory until the actual numbers show up. So I think if the near term earnings estimate is sort of slowing down, then one needs to be cautious," Mistry adds.

Sell TVS Motors, buy Hindustan Unilever: Jay Thakkar

Here are two recommendations by Jay Thakkar, Marwadi Shares and Finance:

-- Sell TVS Motor for a target of Rs 1,003-980 with a stop loss at Rs 1,094

-- Buy Hindustan Unilever Ltd (HUL) for a target of Rs 2,560 and Rs 2,590 with a stop loss at Rs 2,470

Most Read

Share Market Live

View All| Currency | Price | Change | %Change |

|---|