Indian equity benchmarks extended losses to a fourth straight session on Monday as the focus on Dalal Street to the outcome of a key meeting of the RBI's rate-setting panel due this week. Globally, nervousness persisted among investors about steep hikes in COVID-era interest rates and hawkish commentary by central bankers amid fears of slowing economic growth.

Both headline indices fell around two percent during the session before logging their lowest closing levels in two months.

The Sensex dropped as much as 1,060.7 points to 57,038.2 in intraday trade before settling with a loss of 953.7 points for the day — shedding a cumulative 2,574.5 points in four sessions.

The Nifty50 slid to as low as 16,978.3 — cracking below the 17,000 mark for the first time since July 28, down 349.1 points from its previous close.

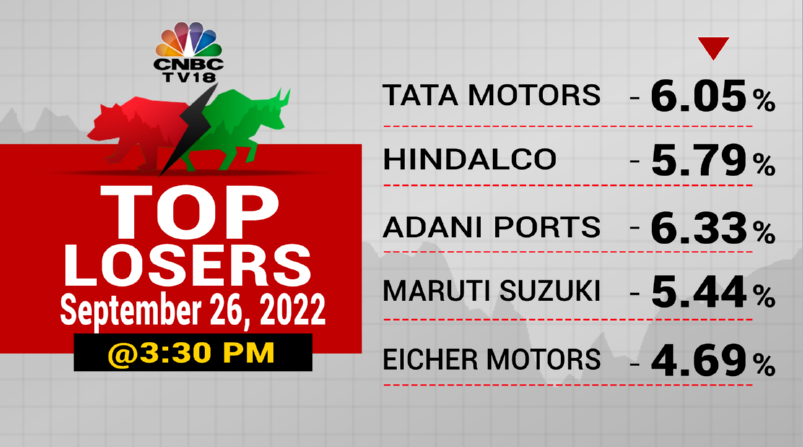

Forty one stocks in the Nifty50 basket finished lower for the day. Tata Motors, Hindalco, Adani Ports, Maruti Suzuki and Eicher Motors were the top laggards.

Tata Steel, ONGC, ITC, Bajaj Auto and Bajaj Finance — ending around 3-4 percent lower — were also among the blue-chip stocks that declined the most.

On the other hand, HCL Tech, Infosys, Asian Paints, Divi's, TCS, Tata Consumer and UltraTech — rising between 0.4 percent and 1.4 percent — were the top gainers.

Reliance, ICICI Bank, ITC, HDFC Bank and Axis Bank were the biggest contributors to the fall in headline indices, together accounting for more than 550 points to the loss in Sensex.

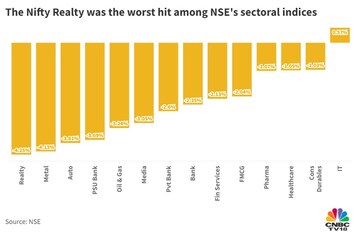

Barring the Nifty IT, all of NSE's sectoral indices took a hit.

The India VIX — known in market parlance as the fear index — rose 6.3 percent to settle at 21.9, its highest close since June 29.

"The soaring dollar, as a result of aggressive monetary tightening, slowing economic growth and rising demand from cautious investors are causing turbulence in the global equity markets. This is creating mayhem in the domestic market led by a weakening rupee, elevated bond yields and pessimistic trends of Asian peers," said Vinod Nair, Head of Research at Geojit Financial Services.

The relative outperformance of the IT space, which has underperformed in the past one year, is in anticipation that a global recession is mostly factored in, he added.

Overall market breadth remained in favour of the bears throughout the day, with 660 stocks rising and 2,925 falling at the close on BSE.

The rupee ended at a record closing low of 81.62 against the dollar.

Global markets

European markets began the day in the red except Italian shares, which jumped led by Telecom Italia and financial stocks after the coalition led by Georgia Meloni looked set to win the country's general election. The pan-European Stoxx 600 index fell as much as 1.1 percent in early hours.

S&P 500 futures were down 0.9 percent at the last count, suggesting a gap-down opening ahead on Wall Street.

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM