Indian equity benchmarks extended losses to a third straight day on Friday amid a market-wide sell-off, as the rupee plunged to an all-time low against the US dollar. Nervousness persisted among investors globally after the Fed's third back-to-back rate hike of 75 basis points and its commitment to taming sticky inflation, which has stayed at 40-year highs.

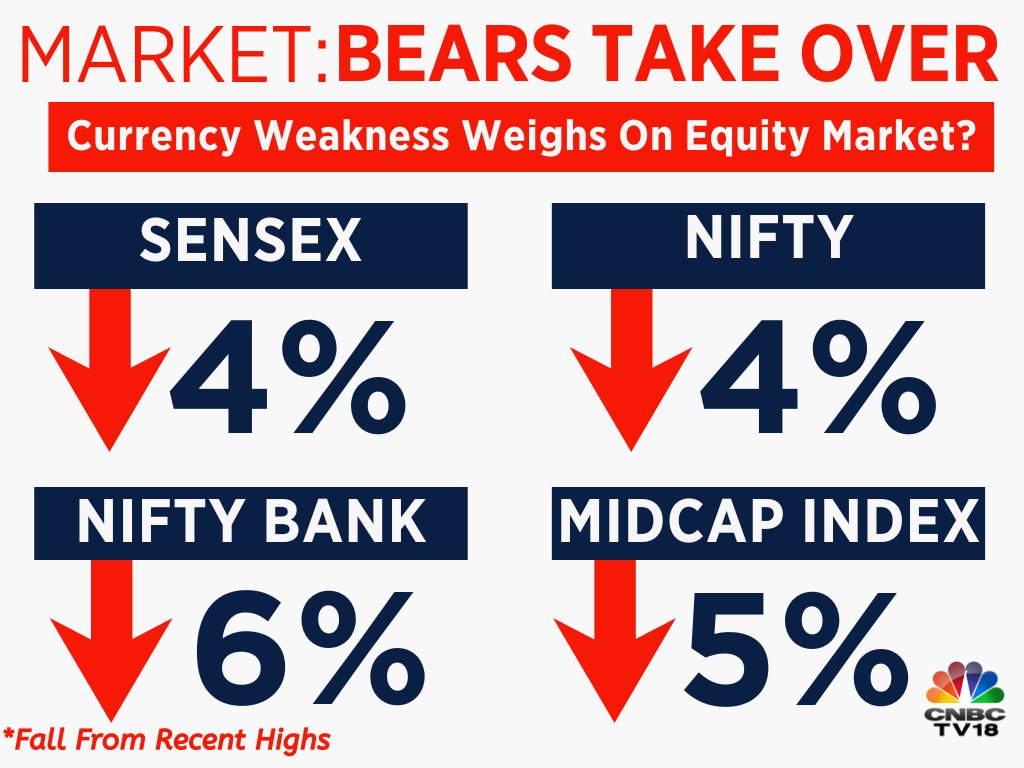

Both headline indices finished close to their weakest levels of the day after falling as much as 1.9 percent during the session. The Sensex tumbled as much as 1,137.8 points to 57,982 in intraday trade — taking its losses to a total of 1,620.8 points in three days.

Investors lost Rs 6.8 lakh crore in three days as the market capitalisation of BSE-listed companies slid to Rs 276.6 lakh crore, according to exchange data.

The Nifty50 slumped to as low as 17,291.7, down 338.2 points from its previous close. Both Sensex and Nifty50 turned negative for the year.

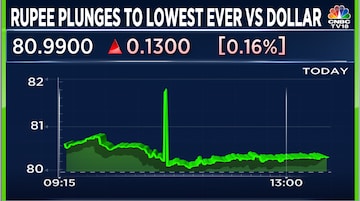

The rupee plummeted to a record closing low of 80.99 against the dollar, hitting a lifetime low of 81.23 during the session.

“Today’s fall has more to do with the weakening rupee, which impacts banking and financial services… The entire BFSI pack has been an outperformer in the recent past and that is where the problem lies,” AK Prabhakar, Head of Research at IDBI Capital, told CNBCTV18.com.

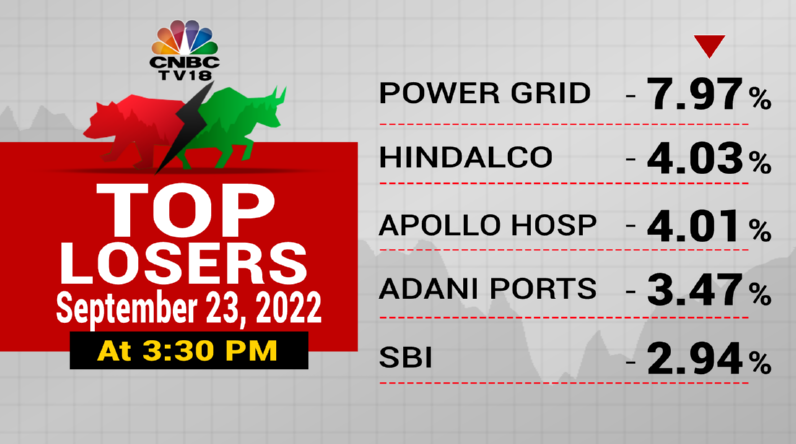

Barring six stocks — Divi's, Sun Pharma, Cipla, Tata Steel, ITC and Infosys, all of the Nifty50's constituents succumbed to negative territory at the close. PowerGrid, Hindalco, Apollo Hospitals, Adani Ports and SBI were the worst hit.

NTPC, UPL, the Bajaj twins, Mahindra & Mahindra, IndusInd and Tata Consumer — falling around three percent each — were also among the blue-chip stocks that fell the most.

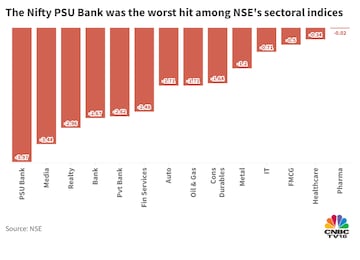

All of NSE's sectoral indices finished the day weaker, even the Nifty Healthcare and the Nifty Pharma — which had bucked the trend for much of the session.

"A rise in the US 10-year bond yield and a strong dollar index influenced FIIs to flee emerging markets. A fall in liquidity in the banking system, a weak currency and premium valuations have set the market outlook bearish for the near term," said Vinod Nair, Head of Research at Geojit Financial Services.

"With aggressive monetary policy action by central banks, the global growth engines are in a slowdown mode, whereas India is currently in a better position with a pickup in credit growth and an uptick in tax collections. But the volatility might persist for a while," he added.

Tata Steel shares eked out a gain of 0.6 percent. The steel giant said Tata group metal companies Tata Steel Long, Tinplate, Tata Metaliks and TRF will be merged into it.

The merger of group companies with Tata Steel is positive from a long-term perspective, Rakesh Arora of Go India Advisors told CNBC-TV18.

M&M Financial Services closed 13.1 percent lower after the RBI restricted the the company from conducting any recovery or repossession operations through outsourcing arrangements until further notice. It, however, permitted M&M Financial to continue such activities through its own employees.

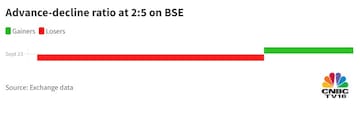

Overall market breadth was extremely negative, as 983 stocks advanced and 2,497 declined on BSE.

Global markets

European markets began the day in the sea of red, mirroring the trend across Asia, as Credit Suisse fell and data highlighting an economic downturn in the region added to worries over hawkish central banks. The pan-European Stoxx 600 index was down 2.1 percent at the last count.

S&P 500 futures were down 1.2 percent, suggesting a gap-down opening ahead on Wall Street.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: From Wayanad to Shivamogga, key battles in the second phase

Apr 25, 2024 2:01 PM

EC probes allegations of MCC violation by Modi, Rahul; seeks response by April 29

Apr 25, 2024 1:32 PM

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM