The Nifty50 clocked a second back-to-back record closing high on Tuesday, boosted by gains in FMCG, healthcare and metal shares, shrugging off mixed moves in global equities as investors weighed nascent hopes that China could ease COVID-related restrictions following protests against optimism about a slowing pace of hikes in benchmark interest rates. Both headline indices gave up half of their intraday gains — owing to selling pressure in heavyweights such as the Bajaj twins, Maruti Suzuki and Larsen & Toubro — to settle 0.3 percent higher.

The Sensex rose 177 points for the day to a record closing high of 62,681.8, having gained as much as 382.6 points during the session. The Nifty50 broadly moved within a range of 18,550-18,700 in intraday trade before ending at 18,618.1. Both main indices rose for the sixth session in a row.

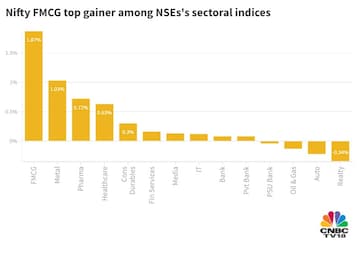

Broad indices underperformed the overall market, with the Nifty Midcap 100 and the Nifty Smallcap 100 falling around half a percent each.

A total of 22 stocks in the Nifty50 universe finished higher, with Hindustan Unilever, JSW Steel, Cipla, Hero MotoCorp and Sun Pharma being the top gainers.

Britannia, Nestle, Dr Reddy's, Tata Steel and Hindalco — finishing around 1-1.5 percent higher — were also among the blue-chip stocks that gained the most.

On the other hand, IndusInd, Coal India, Bajaj Finance, Bajaj Finserv, Eicher, PowerGrid, Maruti Suzuki and UPL — declining between 0.7 percent and 1.5 percent — were the top laggards.

"The ongoing domestic rally is supported by falling crude oil and commodity prices, which are uplifting the corporate earnings outlook. However, there are concerns about the market's medium-term performance due to supreme valuations," said Vinod Nair, Head of Research at Geojit Financial Services.

"Falling raw material costs, better GDP growth and lower inflation are helping the market sustain the current outperformance," he said.

Official data India's gross domestic product in the July-September period is due on Wednesday.

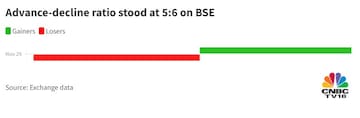

Overall market breadth favoured the bulls at the close, as 1,663 stocks rose and 1,823 fell on BSE.

The rupee ended nearly unchanged at 81.72 against the US dollar.

Global markets

European markets gave up initial gains amid choppy trade in early hours, in stark contrast to a strong session across much of their Asian peers, with the Stoxx 600 index quoting down 0.2 percent at the last count.

S&P 500 futures were up 0.2 percent, suggesting a mildly positive start ahead on Wall Street.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Elections 2024: Can BJP repeat its poll success in Uttar Pradesh? Here's a SWOT analysis

Apr 17, 2024 7:47 PM

Lok Sabha elections 2024: Know what all is closed on April 19 for phase 1 polling

Apr 17, 2024 7:35 PM

Lok Sabha elections 2024: From Nagpur to Chhindwara, key battles in Phase 1

Apr 17, 2024 7:19 PM