Indian equity benchmarks soared to record closing highs on Thursday, finishing the November derivatives (F&O) series more than four percent higher, led by broad-based buying. Dalal Street tracked gains across major markets around the globe after minutes of the Fed's last policy meeting suggested a slowing pace of hikes in COVID-era interest rates soon.

Both headline indices surged around 1.5 percent in the final hour of the session. The Sensex jumped 901.8 points to touch an all-time high of 62,412.3 in intraday trade, and the Nifty50 climbed to as high as 18,529.7, up 262.5 points from its previous close — coming within 75 points of its record high.

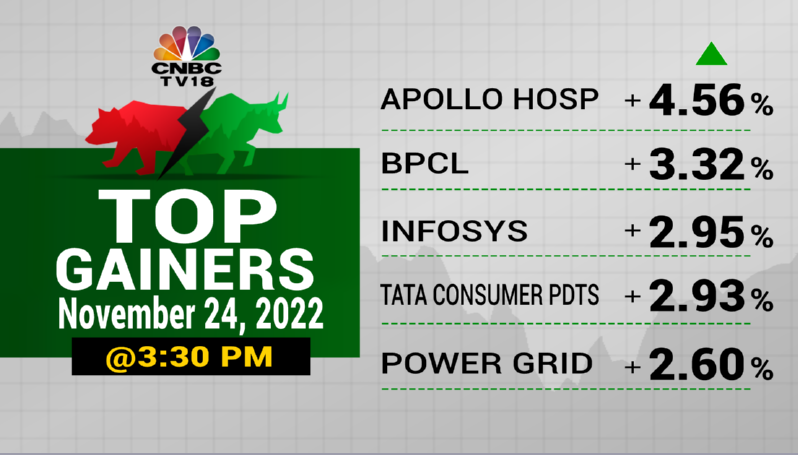

As many as 44 stocks in the Nifty50 basket strengthened for the day. Apollo Hospitals, HDFC Life, Bharat Petroleum, Infosys, Tata Consumer Products, HCL Tech, PowerGrid, Wipro, Tech Mahindra and TCS — ending between 2.3 percent and 4.6 percent — were the top gainers.

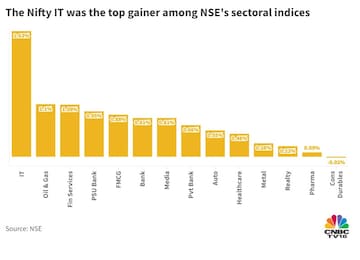

Infosys, the HDFC twins, ICICI Bank and TCS were the biggest boosts for both main gauges.

The Nifty Bank — whose 12 constituents are 12 major lenders of the country — gained as much as one percent to a record 43,163.4 during the session.

"Investors cheered the latest FOMC meeting minutes that hinted that the rate hike cycle may be slowing down. Optimism was further boosted by falling crude prices, over talk of a possible price cap on Russian oil and a rise in US stockpiles, and the declining dollar index," said Vinod Nair, Head of Research at Geojit Financial Services.

Overall market breadth favoured the bulls, as 1,935 stocks rose and 1,570 fell at the close on BSE.

The rupee appreciated 0.3 percent to end at 81.63 against the US dollar.

Global markets

European markets scaled three-month highs mirroring the trend across Asian peers, with investors looking for fresh cues from the ECB. The pan-European Stoxx 600 index gained 0.3 percent to its strongest intraday level since August 19.

S&P 500 futures were up 0.4 percent, suggesting a higher start ahead on Wall Street.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM