The fall in the rupee below the 78 mark against the US dollar for the first time ever may have different repercussions for different segments of the Indian economy. For one pocket — which makes up for nearly one fifth of the economy, it is a boon, as it increases their income by about 1.3 percent on each dollar earned from foreign markets in the last one month alone.

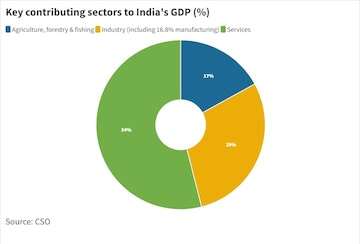

Exporters of goods and services account for 18.7 percent to India's GDP, which expanded 4.1 percent in the January-March period — the lowest pace of growth in a year.

But what about the rest of the economy?

For importers, it is a different story altogether. And the pain might just reach end-consumers, too.

Rupee depreciation makes oil imports more expensive, for instance, which is a major pain point for the economy, as it depends on imports to meet more than 80 percent of its oil needs.

Simply put, higher cost for oil importers can shrink their margins further — after months of margin pressure — and in turn, force them to pass on the cost to customers.

And weakness in the rupee against the greenback may be here to stay.

In fact, it has taken the rupee little more than a month to breach the 78-mark against the US dollar since hitting 77 for the first time ever. This is in stark contrast to its more than two-year-long journey from 76 to 77, which ended in March 2020, just before India imposed its first full lockdown to tackle the pandemic.

A rate hike of around 75 basis points by the US central bank at its June meeting could be a key headwind for the rupee in the near term, said Sugandha Sachdeva, Vice-President-Commodity and Currency Research at Religare Broking.

"Along with rising crude oil prices, the prime culprit behind the rupee losing its value against the dollar is the sharp rally in the greenback, which is witnessing safe-haven flows as market participants are bracing for rapid-fire rate hikes by the Fed in its battle against inflation... That has raised the risk of a growth slowdown. It is leading to massive capital outflows from domestic equities," she said.

"We have witnessed that crude oil is trading on a steady note at around $120 a barrel for the past couple of weeks. Given the country's large dependence on oil imports, the biggest impact of the weakening rupee-dollar exchange rate will be on rising fuel costs and inflation. A depreciating rupee tends to raise inflationary risks as imports become costlier and intensifying price pressure tends to reduce the purchasing power of the common man," Sachdeva told CNBCTV18.com.

While inflation in the US has hit a fresh 40-year high of 8.6 percent, a key reading on consumer prices in India is due later in the day. That when the RBI has raised the repo rate — the key interest rate at which it lends money to commercial banks — by 90 basis points in the past six weeks and raised its inflation forecast for the year ending March 2023 by 100 bps to 6.7 percent.

Economists see downside risks to GDP estimates for India due to factors such as high oil prices.

"Along with the rest of the world and region, India has a downside from external demand being weak. But at the same time, domestic demand will be a decent offset for India," Chetan Ahya, Chief Asia Economist at Morgan Stanley, told CNBC-TV18.

"We expect GDP growth in the fiscal year ending March 2023 to be at 7.6 percent. But we reckon that there are downside risks because commodity prices, especially oil, which is a big challenge for India," he said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM

Lok Sabha Election Phase One: Bengal records 34% voting, Maharashtra 19%, Jammu 23% till 11 am

Apr 19, 2024 12:56 PM

Two TMC activists injured in attack in Bengal's Cooch Behar hours before polling

Apr 19, 2024 12:09 PM

Lok Sabha Polls 2024: Here is how the markets fared in Modi government's second term

Apr 19, 2024 11:44 AM