The Reserve Bank of India (RBI) has directed commercial banks not to take additional positions in the non-deliverable forward market, news agency Reuters reported, citing bankers and traders. The central bank has reiterated several times that it does not target a particular level for the rupee. However, many analysts feel such a move enables it to ensure maximum utilisation of forex reserves to practically do just that: tackle wild swings in the currency market and prevent it from depreciating further.

The build-up of positions is forcing the central bank to spend more from its forex reserves to defend the local currency, the report quoted one of the bankers as saying.

India's forex reserves have shrunken more than 17 percent since an all-time high of $645 billion in October 2021. As of September 30, 2022, the corpus stood at $532.6 billion, as the central bank deployed funds to defend the rupee against jitters emanating from global developments.

The decline was mainly owing to a fall in the RBI's foreign currency assets (FCAs) — a significant component of the overall reserves. The RBI sells dollars from the reserves through state-run banks to support the local currency during unfavourable moves in its global peers.

What non-deliverable forwards really are

A non-deliverable forward — or NDF — is a derivatives contract, meaning a financial instrument whose value is linked to an underlying asset such as a stock, index, currency or commodity. This enables two parties to exchange cash flows basis the difference between the targeted rate and the actual value in the spot market.

Typically, such contracts banks to manage volatility on prevailing exchange rates.

An NDF is similar to a swap, wherein one of the parties settles the contract by paying an agreed-upon rate, known as the notional amount.

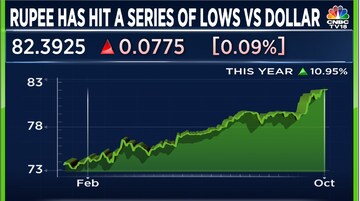

Such a move by the RBI assumes significance as the rupee has hit a series of lifetime lows against the US dollar despite the central bank spending heavily from its forex reserves.

"A significant rise in volumes in the NDF market is leading to high onshore demand for dollars with interest rates in the US on the rise. This is fuelling sharp depreciation in the domestic currency while pushing the RBI to increase its intervention and expend its reserves," Sugandha Sachdeva, Vice President-Commodity and Currency Research at Religare Broking, told CNBCTV18.com.

"Restraining domestic banks to curb their activity in the foreign bank-dominated NDF market might lead to a fall in segment volumes and allow the RBI to actively influence the rupee-dollar exchange rate with its calibrated intervention and spot selling of dollars," she said.

In 2020, the RBI had permitted commercial lenders to trade in non-deliverable forwards, in a move viewed to be aimed at helping the central bank gain more control in the forex market in countering volatility in times of stress.

Heavy positions in the NDF segments, however, have increased demand for the greenback — and putting more pressure on the rupee, leaving the RBI no choice but to intervene.

Also, persistent weakness in the rupee — owing to the dollar hovering around 20-year highs against six other peers — has created arbitrage opportunities between onshore and offshore rates. An arbitrage opportunity enables a trader to deal in the same asset in different markets to earn from the difference in price.

In a typical situation, it boosts demand for the American currency onshore but, in turn, leads to more liquidity offshore.

"Limited participation by local banks in the offshore markets might increase the difference in rates between onshore and offshore destinations (reducing arbitrage opportunities)," Sachdeva explained.

"Over the years, the RBI has had little control over the offshore rupee NDF market and there are risks that any sharp moves in the offshore segment might spill over to the domestic markets."

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM