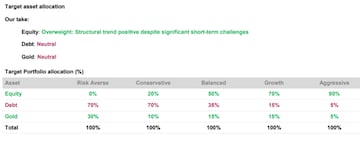

Amid the uncertain times that we are in as we fight the second wave of COVID, diversification of assets is the key to maximise returns, Axis Securities said in its latest report. According to Axis Securities, allocations and sector rotation will play a crucial role in generating outperformance this year.

Among asset classes, equity market is likely to be the best-performing one for the next 1-2 years, said the report, adding that though there are short-term challenges owing to the surge in COVID cases, the structural trend continues to remain positive.

Equity

The brokerage, in an earlier note, had cut FY22 earnings by 6 percent for Nifty50. Considering a strong run in commodity prices and an improving global situation, the Nifty50 is unlikely to see any major downgrades in the near term, it said. The market will remain rangebound but it does offer good opportunities across the spectrum of sectors to add quality stocks that can generate excellent long-term returns, said the brokerage. It also maintains December Nifty target at 16,100.

According to Axis Securities, the market positioning is slowly shifting towards defensive and selective cyclical plays. Furthermore, concerns over lockdown-led restrictions are clearly visible in interest rate-sensitive sectors.

"At the current juncture, the ‘Sector Rotation’ theme will likely play out in the near term. IT, Telecom, Pharma, Consumer staples, and rural themes will be less impacted and are likely to outperform. On the other hand, the impact on Retail, Travel, Tourism, Hotels, BFSI, Discretionary Consumption, and Autos will be significant and these sectors may underperform in the near term due to the challenging economic circumstances," it noted.

Fixed Income

Yields remained muted for the second half of April on the expectation of easy monetary policy for an extended period of time amidst the worsening scenario of COVID 2.0, it said.

"Economic recovery was strong till March post which the second wave is gripping pace across the country, impacting the economic activities due to induced localised lockdown and mobility restrictions," the brokerage noted.

Moving forward, the severity of localised restrictions and the lockdown duration will decide the dent in consensus expectations, it said. It continues to favour a quality approach in bonds with some non-AAA exposure based on individual risk appetite.

Gold

Factors like investors betting higher on riskier assets like equity, vaccine developments, faster than expected economic recovery in global markets are keeping the gold prices under pressure, said Axis Securities.

Based on these fundamental pressures, gold is the biggest underperformer for the first four months of 2021 versus other asset classes. This can be manifested in the last four months’ gold prices which are down by 7 percent in rupee and dollar terms, it said.

Rising bond yields are also now a short-term negative for the gold prices. However, the brokerage said gold will continue to attract investments to hedge risk against other asset classes.

"Liquidity infusion in gold is likely to continue in 2021 while a passage of US stimulus will be a key for a further rally in it," said the brokerages.

It continues its Neutral stance on gold and recommends a 'buy on dips' strategy.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: All you need to know about EVMs and VVPAT; how they work

Apr 20, 2024 1:24 PM

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM