A short-covering rally on Wall Street on Thursday sent positive cues to the rest of the world, triggering a broad-based surge on Dalal Street. The surge came about even as a worse-than-expected inflation reading from the world's largest economy reinforced fears about steep rate hikes and their impact on economic growth.

The S&P 500 — one of the three main US equity benchmarks — finished the day 2.6 percent higher, in a dramatic recovery after falling as much as 2.4 percent earlier in the day. How did it happen and will the momentum last for the US, India, and the rest of the world?

Short-covering — which essentially means buying to settle initial bets to sell —refers to the purchase of shares to close an open short position. Let's say several traders shorted their positions in anticipation of a key event, after which, they want to square off or settle their positions. This creates a jump in the underlying security.

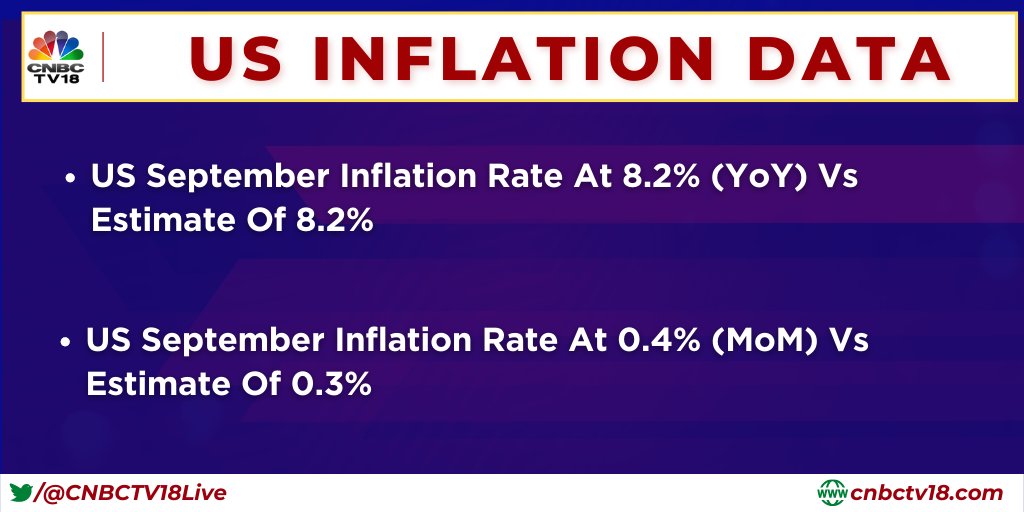

This is pretty much what happened on Wall Street on October 13: Traders reversed course after initially flipping to safety mode after the release of the US inflation reading for the month of September came in at 8.2 — largely in line with estimates.

After the release of actual data, they made a comeback to riskier bets — having digested the event, even though it means steep rate hikes may continue in the US and the rest of the globe two years into the pandemic.

A four percent sequential increase in a weekly US jobless reading kept investors cautious.

"I don't think we are out of the woods yet as far as global markets are concerned, especially the US," Rahul Shah, Co-Head of Research at Equitymaster, told CNBCTV18.com.

How can one tell if a rise is really due to short covering?

A decrease in open interest (in derivatives positions) along with an increase in price is a defining combination that indicates short covering.

How does it work?

"The uncanny ability of the market to surprise was in full flow on Wall Street... Such sharp rallies happen due to market positioning. The market was oversold on expectations of higher inflation and the consequent continuation of the hawkish Fed stance. This oversold market positioning triggered short covering," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Indian equity benchmarks Sensex and Nifty50 mirrored the US move with a surge of almost two percent each backed by buying across sectors.

"The big question is about the durability of this rally. Under the present unfavourable global macroeconomic construct, the rally is unlikely to sustain beyond a level," Vijayakumar said.

A sticky US consumer inflation reading around the highest levels in four decades has forced the Fed — the American central bank — to take up a series of big hikes in COVID-era interest rates — making money more expensive helps in cooling off the prices consumers pay to buy goods and services, sending jitters across the world.

But the challenge is to address inflation without hampering growth — a balance that may not be so easy to strike in every macroeconomic situation.

Although much of rate hikes have been factored in, steeper and more frequent increases than thought earlier — and the warnings that more are coming — are damaging investors' appetite for risk. This has caused wild swings in the markets over the past few months.

Earlier this month, the rupee sank below the 82 mark against the US dollar for the first time ever, having hit a series of unprecedented lows over the past few weeks. The dollar index — which gauges strength in the greenback against six other peers — continues to hover around the highest levels in 20 years.

The dollar is viewed as a safety net, just like gold. Investors rush to the safety of dollars in times of financial uncertainty.

Many analysts feel the dollar will continue to strengthen in the short term.

"Dollar appreciation is the way we see things, but we could be swinging around close to the year and perhaps even a little bit before that,” Rob Carnell, Head of Research and Chief Economist-Asia-Pacific at ING Bank, told CNBC-TV18.

The road ahead

The June 16 low on S&P 500 could be the bottom for the market, according to Ed Yardeni, President of Yardeni Research.

"I really think that the June 16 blow up, which was 3,666 (S&P 500), is turning out to be sort of roughly the bottom of this trading range that I see through the end of the year. And I think the upper end of the trading range is 4,305 on the S&P 500, which is where we were on August 16,” he told CNBC-TV18.

Most analysts back home feel the rise will be short-lived.

"We should be prepared for more such wild swings in the near future as well," said Shah of Equitymaster.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

West Bengal Lok Sabha elections: Abhishek Banerjee to Mahua Moitra, a look at TMC's candidates

Apr 19, 2024 6:14 PM

Chhattisgarh Lok Sabha elections 2024: Bhupesh Baghel among the list of Congress candidates

Apr 19, 2024 3:45 PM

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM

Election Commission: Nearly 60% polling till 5 pm in phase one of Lok Sabha polls

Apr 19, 2024 12:56 PM