Maruti Suzuki shares continued to rise for the seventh session in a row on Wednesday, ditching overall weakness on Dalal Street, even as brokerages held mixed views on the carmaker's market share. According to CLSA, Maruti Suzuki's goal of achieving 50 percent market share in the year ending March 2024 "remains a dream".

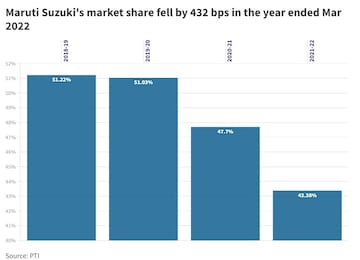

Maruti Suzuki's market share in passenger vehicles slipped below the 50 percent mark in the year ended March 2021 given its limited presence in SUVs at a time of growing popularity of the segment in the country.

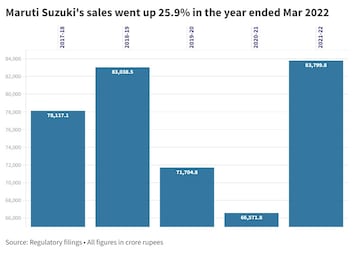

The company needs incremental revenue of Rs 23,000 crore, earnings before interest, taxes, depreciation and ammortisation (EBITDA) of Rs 2,800 crore, and margin of 10.8 percent to reach the milestone, according to CLSA.

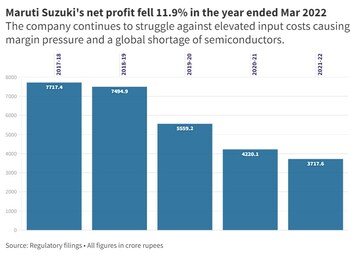

It will be a tough ask given the competitive intensity in the SUV, hatchback and multi-purpose vehicle (MPV) segments, CLSA said.

The brokerage maintained a 'sell' call on Maruti Suzuki with a target price of Rs 7,053 apiece.

However, not all brokerages have negative views on Maruti Suzuki.

| Brokerage | Rating | Target | Target vs Tuesday's price (%) |

| CLSA | Sell | 7,053 | -16.9 |

| BofA Securities | Buy | 9,500 | 11.9 |

| Motilal Oswal | Buy | 10000 | 17.8 |

Motilal Oswal Financial Services expects Maruti Suzuki's market share to improve by around 600 bps to 49 percent by March 2024, based on the carmaker's launch pipeline of four SUVs, a platform upgrade and a mid-cycle refresh.

The brokerage's target price suggests a 17.8 percent upside in the stock from Tuesday's level.

BofA Securities has a 'buy' rating on the stock with a target price of Rs 9,500 — implying an upside of 11.9 percent from Tuesday's closing price.

On Monday, the brokerage raised its earnings per share (EPS) for the auto company by 7-9 percent citing multiple favorable factors that can drive earnings upgrades.

Maruti Suzuki shares have risen more than 11 percent in the past six sessions.

First Published: Jun 29, 2022 1:26 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM