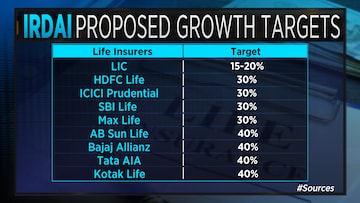

The Insurance Regulatory and Development Authority of India (IRDAI) has

proposed to set growth targets for insurance companies. The industry and the market are divided about this proposal with some feeling that this will prompt the insurance players to have "skin in the game" while others believe that the regulator should restrict its role to facilitating business.

Nilesh Sathe, a former member of IRDAI, believes the move is in the right direction.

“After the new chairman took over, he has a series of meetings with the CEOs, the promoters and he has formed various committees and he has always been believing that ease of doing business has to be there. In order to increase the penetration, there is nothing wrong if a regulator sets higher targets for the insurance companies... Voluntarily if insurance companies take those targets, it will help,” he said.

However, according to Swami Saran Sharma, founder at Insuringindia.Com, if IRDAI pushes one agenda, it automatically becomes an anti-thesis for the other.

“IRDAI has two functions, development as well as regulation. If you regulate too much, it will curtail development and vice versa. So instead of setting targets, IRDAI should restrict its role to facilitating business,” he said.

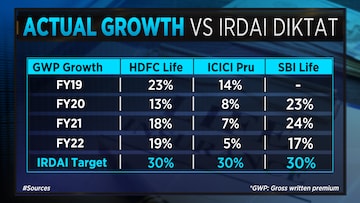

Sharma believes setting higher targets is not a bad idea provided it has a base in reality. “IRDAI is looking at a 500 percent growth in next five years, which has not happened in the past.”

Jigar Mistry, the co-founder at Buoyant Capital, is positive about the move as it will help set a base.

“As far as they are open to suggestions, I don’t think there will be a problem with them setting the numbers. It does help set a base. Skin in the game is also a great example. All these are the steps in the absolutely right direction,” he said.

For the entire discussion, watch the accompanying video