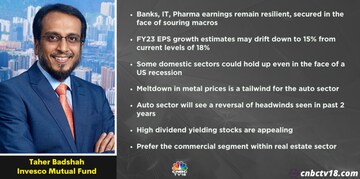

Significant earnings downgrades are unlikely in the remaining months of the financial year 2023 as banks, IT and pharma sectors remain "quite resilient" to inflationary conditions, said Taher Badshah, CIO-Equities at Invesco Mutual Fund, on Monday.

“At least for FY23, it's a little difficult to see significant amount of downgrades from here, from what we have already seen in the last six months, primarily, because if you look at the configuration, you will probably find banks, IT and pharma being roughly about 50 percent of the earnings and that is something which I would say is quite resilient, not immediately impacted or directly impacted by high commodity prices, and very high inflation at this stage," he said in an interview with CNBC-TV18.

According to him, the Nifty earnings per share (EPS) growth estimates have dropped to 18 percent for FY23 and 13 percent for FY24.

“Since the start of the year, we have already seen Street downgrade some part of their earnings expectations. So probably what was more like 20 percent plus expectations for the next two years, 2023 and 2024 – that kind of moderated down to more like 18 percent for 2023 and probably 13-14 percent for 2024,” Badshah said.

He added that the FY23 EPS growth estimates may drift down to 15 percent from current levels of 18 percent during the course of the year.

Badshah said India could have reasonably decent pockets which would continue to do well amid US recession. "It's not necessary that every part of the economy needs to be dripped down along with the US recession," he said.

A meltdown in metal prices is a tailwind for the auto companies, he said, adding that the sector will see a reversal of headwinds seen in the past two years.

According to him, high dividend-yielding stocks are appealing. Invesco Mutual Fund prefers the commercial segment within the real estate sector, he added.

For the entire interview, watch the accompanying video