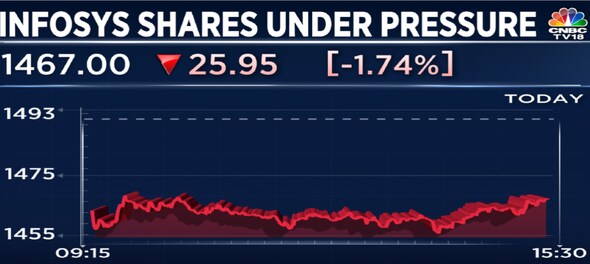

Infosys shares fell on Thursday as rising US bond yields dented the sentiment for India's IT sector, which relies on global markets such as the US for the lion's share of its revenue. The stock of Infosys — India's second largest software exporter — fell as much as almost three percent during the session before recovering some of those losses.

Infosys shares settled at Rs 1,464.4 apiece for the day on BSE, down by Rs 28.8 or 1.9 percent from their previous close.

Analysts said some profit booking in the stock following sharp gains in the previous session also contributed to the fall on Thursday. The stock rose 2.1 percent on Tuesday, and the Indian market remained closed the next day for a holiday.

Hemen Kapadia of KRChoksey Securities believes the recent correction in the Infosys stock is more of a technical correction.

"The stock has moved from a low of Rs 1,372 to a high of Rs 1,630 in a matter of a couple of months... One has to keep in mind that Infosys and the entire IT pack is in a corrective phase. The bull run has taken a breather for the time being and I don’t think it’s going to resume for the next few months at least... So it was a recover, not a rally," he told CNBCTV18.com.

A bounce may be just around the corner though the worst may not be over as far as the price erosion is concerned, he said.

Persistent concerns over an impending recession in the US, as the Fed stands pat on a path of aggressive hikes in COVID-era interest rates, triggered a spike in bond yields on Thursday.

The yield on the two-year bond hit a 14-year high of 3.51 percent and that of the 10-year bond inched higher to 3.22 percent. Rising bond yields indicate lower bond prices as investors sell bonds in anticipation of higher interest rates in future.

Higher yields are typically considered negative for technology and other growth stocks, hurting the current value of the future earnings and cash flow that their valuations are based on.

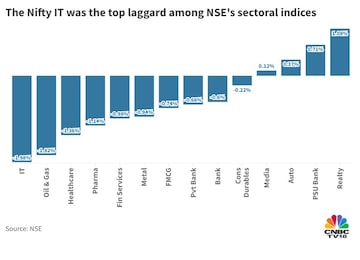

Other stocks in the IT basket also succumbed to selling pressure, sending the Nifty IT — which tracks the performance of 10 stocks including TCS, Infosys, Wipro, HCL Tech and Tech Mahindra — tumbling by two percent.

TCS fell 2.3 percent, Wipro 0.7 percent, HCL Tech 1.3 percent and Tech Mahindra 1.9 percent for the day.

TCS fell 2.3 percent, Wipro 0.7 percent, HCL Tech 1.3 percent and Tech Mahindra 1.9 percent for the day.Infosys shares have fallen more than five percent in the past one month, a period in which the Nifty50 benchmark has risen 1.2 percent.

The IT index has dropped 4.7 percent during this period.

"Infosys needs to take some more time to correct after this huge move from almost Rs 500 to Rs 1,950... I don’t think IT as a sector is going to remain on the forefront of things and it will take some time for things and the correction to play out," Kapadia added.

First Published: Sept 1, 2022 4:55 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Every student suicide pains me, I will try better: BJP Kota MP Om Birla

Apr 16, 2024 2:19 PM

Bihar Lok Sabha elections 2024: Schedule, total seats, Congress candidates and more

Apr 16, 2024 1:02 PM

Lok Sabha polls: BJP drops Som Parkash, fields Abhijit Das against Mamata's nephew

Apr 16, 2024 12:49 PM