Tech giant Infosys, in line with analysts' expectations, has announced that it will consider a proposal for a buyback of fully paid-up equity shares of the company at its meeting on Thursday. The Street remained positive on the IT stock despite an overall negative trend in the market.

After rising 0.7 percent in early deals, Infosys shares were trading 0.29 percent higher from the previous close at Rs 1,467 at 9:21 am on BSE.

This comes ahead of the company's board meeting to discuss the buyback proposal and to finalise July to September quarter results later this week. The firm has not yet revealed any other details of the buyback proposal.

Under a share buyback or repurchase, a company buys back its shares from investors or shareholders. It is an alternative, tax-efficient way to return money to shareholders.

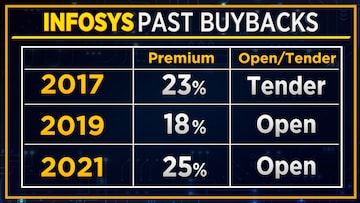

Last year, the Infosys board approved an up to Rs 9,200 crore buyback plan, which commenced on June 25, 2021.

Meanwhile, global brokerage Citi has a buy rating on Infosys stock and sees an 11 percent upside in it from Monday's closing price to Rs 1,625 per share.

The brokerage believes that an open market buyback for Infosys may provide support to the stock, which erased more than 22 percent of investors' wealth in 2022 (year-to-date) as against benchmark Sensex, which has dipped 2 percent in during the period.

Also Read:

It noted that the last two buybacks were open market and were of an aggregate amount of Rs 9,200 crore and Rs 8,260 crore, respectively. It added that the two took at least five months to complete.

According to Citi, Infosys needs to meet its capital allocation policy and its cash on books as of the April to June quarter stood at $4.5 billion, which the firm must monitor.

The remark comes as Infosys has a capital allocation of 85 percent of its free cash flow until the fiscal year 2024 through a combination of dividends and buybacks. Until the fiscal year 2022, the company has returned nearly 73 percent of its free cash flow to its investors.

Jefferies expects Infosys to announce a buyback valued between Rs 8,700 crore and Rs 9,500 crore.

IIFL thinks the maximum size of the buyback can be Rs 18,500 crore considering a net worth of Rs 74,000 crore. It believes the buyback is likely to be Rs 11,000-12,000 crore, which is 15-16 percent of net worth.

It also expects the buyback to be an open market buyback with an expected max price of Rs 1,800 per share.

The share buyback announcement comes ahead of Infosys' quarterly financial results. Its revenue growth in constant currency terms is likely to be the highest among its large-cap peers, according to a CNBC-TV18 poll. The poll suggests that the tech company's rupee revenue and operating profit are likely to grow in the high-single digits while net profit may grow in the mid-single digits.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Two TMC activists injured in attack in Bengal's Cooch Behar hours before polling

Apr 19, 2024 12:09 PM

Lok Sabha Polls 2024: Here is how the markets fared in Modi government's second term

Apr 19, 2024 11:44 AM

Lok Sabha elections 2024: Dibrugarh braces for intense electoral battle

Apr 19, 2024 11:18 AM

Haridwar Lok Sabha elections: Tight contest between BJP, BSP, and Congress

Apr 19, 2024 10:33 AM