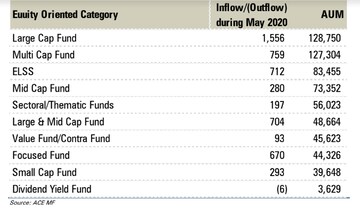

The inflows into equity funds continued but the pace declined over the last two months, a recent report by ICICI Direct stated. May inflows in equity mutual funds stood at Rs 5,257 crore as compared to Rs 6,213 crore in April and Rs 11,723 crore in March 2020.

In the last four months, between February and May, the equity markets have witnessed a roller coaster ride. While equity markets corrected around 40 percent from February highs to March lows but later recovered 35 percent from lows.

"While investors seem so much worried about COVID-19 related market fall, in the last six months, market cap funds (large/mid/small/multi-cap) category's average return is between -12 percent and -14 percent," the report quoted.

Sectorally, it has been an extremely polarised market with the pharma sector outperforming significantly while banking witnessed the brunt of NPA concerns due to the countrywide lockdown, added the note.

The report also stated that retail investors, however, have shown significant maturity by continuing investment at lower levels as well with SIP inflows in May remaining well above Rs 8,000 crore-mark.

It further mentioned that large-cap funds witnessed higher inflows in two months, while small-cap and midcap funds saw reduced inflows due to a sharp sell-off and a weak environment made investors cautious.

"We continue to prefer multi-cap funds as they offer fund managers the flexibility to allocate funds across all market segments, especially in the current market where many smaller cap stocks offer a good investment opportunity," the brokerage house said.

It also advised that investors may also consider investing lumpsum amounts in midcap/small cap funds from a long term perspective.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM