All eyes will be on the RBI's policy statement on Dalal Street this week, besides movement in the rupee against the US dollar and foreign fund flows. The outcome of three-day deliberations of the central bank's Monetary Policy Committee comes days after the Fed delivered a third back-to-back increase of 75 bps in the key US interest rate to counter red-hot inflation.

The week that was

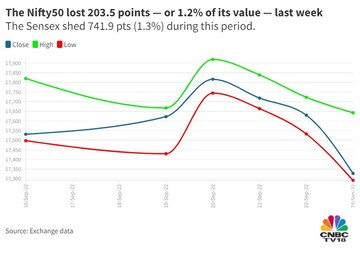

Indian equity benchmarks Sensex and Nifty50 fell more than one percent lower last week — a second straight weekly loss, amid selling pressure in the financial services pack.

The rupee slumped to a record closing low of 80.99 against the dollar at the fag end of the week, after hitting an unprecedented 81.23 during the session.

Globally, the Fed's third big rate hike and hawkish commentary, and rising geopolitical tensions continued to keep investors nervous.

Friday's fall was more due to the weakening rupee, which impacts banking and financial services, said AK Prabhakar, Head of Research at IDBI Capital Markets.

"The entire BFSI pack has been an outperformer in the recent past and that is where the problem lies,” he told CNBCTV18.com.

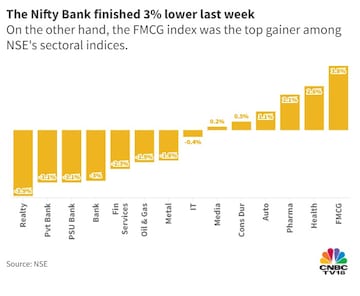

On the other hand, gains in spaces such as FMCG and healthcare lent some support.

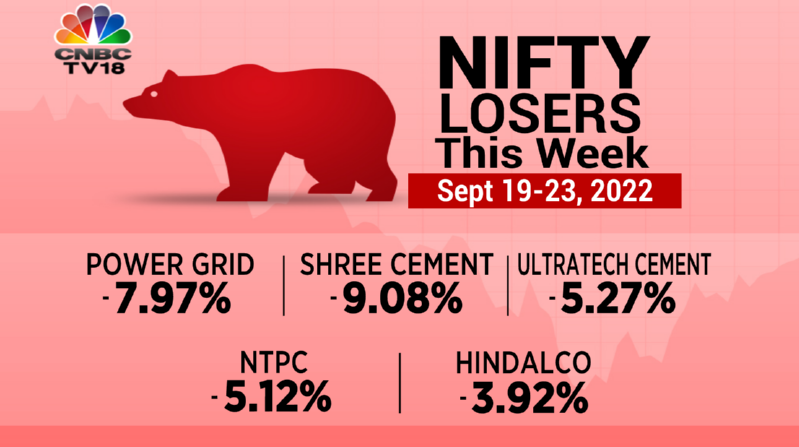

A total of 31 stocks in the Nifty50 basket finished the week in the red. PowerGrid, Shree Cement, UltraTech, NTPC and Hindalco were the top laggards. IndusInd, Coal India, Kotak Mahindra Bank, Larsen & Toubro and HDFC Bank — falling around 3-4 percent each — were also among the blue-chip stocks that fell the most.

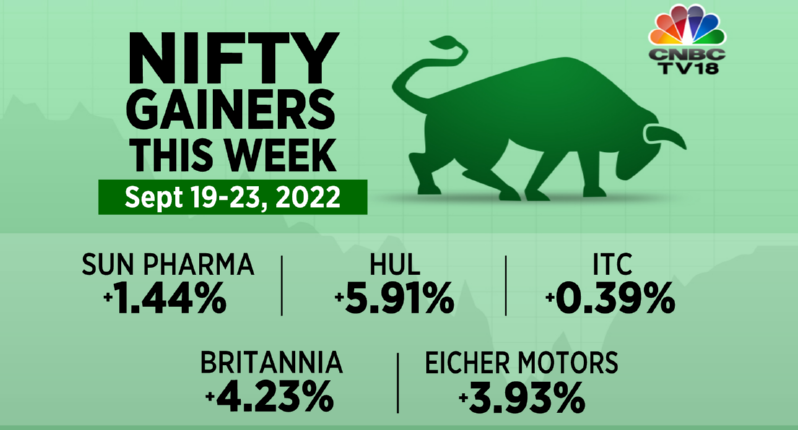

On the other hand, Sun Pharma, Hindustan Unilever, ITC, Britannia, Eicher, Apollo Hospitals, Bajaj Finance, Hero MotoCorp, Cipla and Titan — rising around 2-4 percent each — were the top gainers.

Foreign institutional investors finished a second back-to-back week as net seller of Indian equities.

Here are the key factors and events that are likely to influence Dalal Street in the week beginning September 26:

DOMESTIC CUES

Monetary policy

The RBI is due to announce the outcome of three-day deliberations of its Monetary Policy Committee at 10 am on Friday. The central bank is widely expected to announce a hike in the repo rate — the key rate at which it lends short-term funds to commercial banks.

All eyes will be on RBI Governor Shaktikanta Das's commentary after the release of the policy statement for clues on the future course of rates and clarity on the central bank's assessment of the state of the economy.

Macroeconomic data

Data on production in eight core sectors — coal, oil, natural gas, refinery products, fertilisers, steel, cement and electricity (together known as infrastructure output) — is due later that day.

IPO market

Harsha Engineers will debut on in the secondary market on Monday. Shares in Harsha — a manufacturer of precision bearing cages — were available for bidding in a price range of Rs 314-330 in multiples of 45 under its IPO, which concluded on September 16 with an overall subscription of almost 75 times the equity on offer.

GLOBAL CUES

| Date | US | Europe | Asia |

| Sept 26 | Fed officials Susan Collins and Raphael Bostic to speak | ECB President Christine Lagarde, Vice President Luis de Guindos and Executive Board Member Fabio Panetta to speak, BoE MPC Member Silvana Tenreyro to speak | Japan manufacturing and services PMI data, BoJ Governor Haruhiko Kuroda to speak, Hong Kong trade data |

| Sept 27 | Fed officials Loretta Mester, Charles Evans and James Bullard to speak, home sales data | Christine Lagarde and Luis de Guindos to speak, France unemployment data | |

| Sept 28 | Fed officials Mary Daly, Raphael Bostic, Charles Evans and James Bullard to speak | Germany and France consumer confidence data, Christine Lagarde to speak | Minutes of BoJ's last policy meeting |

| Sept 29 | Loretta Mester to speak, jobless claims data, consumer spending data | Eurozone economic sentiment, consumer confidence and inflation data, Germany inflation data | |

| Sept 30 | Fed officials Mary Daly and Brainard Fed to speak | UK GDP data, Germany retail sales and umemployment data, France inflation and household consumption data, Eurozone inflation and unemployment data | Japan unemployment, industrial production, consumer confidence and retail sales data, China manufacturing PMI data, Hong Kong retail sales data |

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM