The mutual fund industry is witnessing interesting times. On one hand, foreign institutional investors (FIIs) are pulling out but, on the other, domestic institutional investors (DIIs) are showing good momentum.

Speaking to CNBC-TV18, Swarup Mohanty of Mirae Asset Investment and A Balasubramanian of Aditya Birla Sun Life AMC threw light on the industry's recent report card.

| Month | FIIs (Rs cr) | DIIs (Rs cr) |

| June 2022 | -56,123.26 | 44,373.57 |

| May 2022 | -54,292.47 | 50,835.54 |

| April 2022 | -40,652.71 | 29,869.52 |

| March 2022 | -43,281.31 | 39,677.03 |

| February 2022 | -45,720.07 | 42,084.07 |

| January 2022 | -41,346.35 | 21,928.40 |

| December 2021 | -35,493.59 | 31,231.05 |

| November 2021 | -39,901.92 | 30,560.27 |

| October 2021 | -25,572.19 | 4,470.99 |

Domestic participation, as shown in the table above, has been steady at a time when foreign players have been pulling out.

“It's been such a welcome change to see because there was this big thing that when there is a sale in the stock markets, people run away. But that is not what Indian retail investors have been showcasing in the past two years, for sure,” said Mohanty.

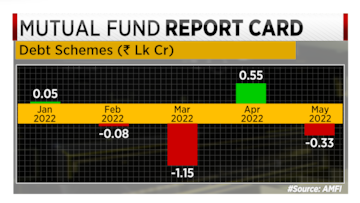

There is a growing appetite for debt mutual funds the continuous rise in interest rates, as it is seen as a safer bet during a downturn.

“After two years of dull period in fixed income market where the MF industry, especially the top players, built a strong franchise on a fixed income, asset management capability, the last two years saw no action. This year, a continuous rise in interest rates and the expectation of a hike in interest is being factored into the bond curve. Clearly, there is a growing appetite for fixed income schemes,” said Balasubramanian.

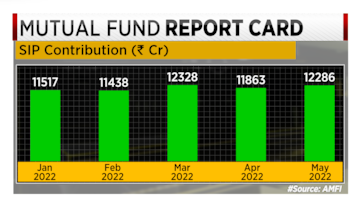

Retail investors too have taken the SIP (systematic investment plan) route to invest in equities and this, again, is a sign of the uncertainty in the markets but shows the growing appetite in the country.

"MF campaigns played a crucial role in retaining retail investors during market volatility," Balasubramanian said.

For the full discussion, watch the video