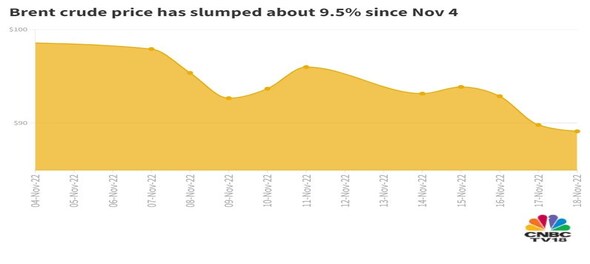

Crude oil prices have cooled off as much as 11.6 percent in the past 11 days — a boost for India, which meets the lion's share of its oil requirement through exports. Lower oil rates also support the domestic currency against the US dollar — which has hovered around 20-year highs against six other peers for the past few months, as importers buy fewer dollars to fund the same quantity.

As of Monday, Brent crude — a global benchmark for oil rates — has lost $11.4 of its value to $87.2 a barrel since November 4.

The latest bout of cooling off oil prices comes amid fears of at least a mild global recession — starting from the world's largest economy, relative easing of geopolitical tensions in Europe and concerns about the reemergence of pandemic-related lockdowns in China. The US, China and India are the largest consumers of crude oil around the world.

Analysts fear more of steep hikes in interest rates to tackle red-hot inflation may send major economies into a state of overheating, causing a blog on global demand.

Where is oil headed?

"While decoding the contrasting forces playing out, we see strong support for oil prices at $80 a barrel, but Brent crude looks set to enter bearish terrain if it slips below $80 a barrel convincingly... In that case, we reckon oil prices to drop towards $65-$60 a barrel in the coming months," Sugandha Sachdeva, VP-Commodity and Currency Research at Religare Broking, told CNBCTV18.com.

She sees Brent finding resistance around $100 a barrel.

"The markets are anticipating the Fed’s peak terminal rate of five percent in 2023, noticeably higher than the 4.6 percent indicated by September’s dot plot, which could further take a toll on the global economy," she said.

Here are three primary factors at play in the oil market:

Ravindra Rao, VP-Head Commodity Research at Kotak Securities, expects WTI crude oil to move within a range of $81.5-85 a barrel in the near term.

He sees support for the contract at $81.5-81 a barrel, which he believes, if compromised, might lead towards a key hurdle at $85/bbl.

First Published: Nov 19, 2022 1:20 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM

Surat polls: Congress moves EC claiming three proposers of party's candidate may have been abducted

Apr 23, 2024 12:59 PM