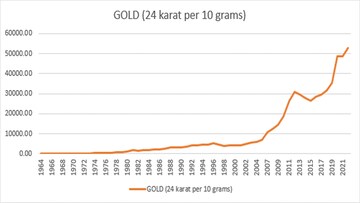

In 2019, World Gold Council estimated that Indian households hold about 25,000 tonnes of gold in various forms. Given that 10 grams of gold cost over Rs 50,000, that’s quite a tidy sum. It also makes India the largest holder of yellow metal. And, despite all the push towards the financialisation of savings to unlock capital and the arguments about gold being an unproductive asset, this isn’t quite a bad thing for the households themselves.

FOR INDIANS GOLD GLITTERS

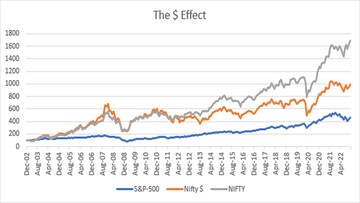

When evaluating returns on asset classes, it is important to understand who the investor is. What are great returns for one investor, need not always be as good a return for another. Let’s take the case of equities. For Indian investors in equities, the Nifty has returned 9 percent since November last year. But if we look at what a foreign investor would have earned over the same period, the return is a paltry 0.3 percent in dollar terms, though still way better than the decline of almost 12 percent in the S&P-500.

What’s more, while the Nifty Dollar Index has a very low correlation of 0.34 over a 20-year period to the dollar Index, this is 0.54 for the Nifty. And, this aspect should be kept in mind, while trying to assess how foreign investors might behave when stocks run up and the dollar starts to slip. But that topic is for another day. And needless to say, both Nifty indices above have a very high correlation to the S&P-500.

Back to gold. While investors who bought gold in dollars have lost 1.2 percent in value since November last year, investors in 24-carat gold in India have earned a return of over 8 percent, that’s better than what any fixed income option has offered over the same period and isn’t much worse off than the 9 percent delivered by equities.

In fact, gold in rupee terms has had a healthy return track record, given the consistent decline of the rupee against the dollar. And the Indian chart for 24-carat gold shows a very secular uptrend over the years, primarily for this reason.

So, don’t scoff at gold. The historical returns and the currency hedge argument make a compelling case for Indians to keep their faith in the yellow metal.

THE WORLD IS BETTING ON GOLD

What’s more interesting today is that the sanctions on Russia are driving several central banks in large and small economies to diversify their holdings beyond the currencies of other nations. And this is also sparking debate about the future role of gold.

Also Read: 'One India One Gold Rate' | Kerala to introduce uniform gold price — How will you benefit?

Earlier this week, Ghana said it is working on a policy to buy oil with gold instead of US dollars. World Gold Council recently published a paper on this aspect titled: “International Reserves after the Russia Sanctions: A Role for Gold?” In the paper, Prof. Barry Eichengreen asks whether financial sanctions imposed on Russia and specific steps taken by a group of countries, led by the United States, to freeze the foreign reserves of the Bank of Russia will augur important changes in the international monetary and financial system to enhance the international monetary and reserve role of gold.

Interestingly, China seems to be in the news over likely gold accumulation to diversify its holdings. Reports point to the aggressive buying of gold by China and Turkey at a premium. According to World Gold Council’s November release for the July-September period, “Global central bank purchases leapt to almost 400 tonnes in Q3 (+115 percent QoQ). This is the largest single quarter of demand from this sector in our records back to 2000 and almost double the previous record of 241 tonnes in Q3 2018. It also marks the eighth consecutive quarter of net purchases and lifts the YTD total to 673 tonnes, higher than any other full year total since 1967”. That’s a startling amount of buying.

Even the RBI has been building its gold reserves. It bought 13 tonnes in July and 4 tonnes in September, pushing its gold reserves to 785 tonnes.

The question to ponder is if central banks are reposing their faith in gold, should you not? For investors, it is best to keep gold as a part of your portfolio, and today you have a range of options besides physical gold, to choose from.

(Edited by : Priyanka Deshpande)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha elections: Gurugram Police issues heatwave advisory for voters

Apr 20, 2024 6:08 PM

2024 Lok Sabha elections: Unable to find your voter ID? Here are alternative docs to cast vote

Apr 20, 2024 5:48 PM

Lok Sabha elections 2024: All you need to know about EVMs and VVPAT; how they work

Apr 20, 2024 1:24 PM

Odisha Lok Sabha elections: Schedule, total seats, Congress candidates and more

Apr 20, 2024 11:39 AM