Indian equity benchmarks started the last session of the trading week in the green, ahead of a key rate decision by the RBI. The central bank's Monetary Policy Committee is widely expected to announce a raise in the repo rate — or the key rate at which it lends money to commercial banks — on Friday, having already increased it by 90 basis points since May.

Both headline indices rose as much as 0.3 percent in the first few minutes of trade. The Sensex gained 195 points to touch 58,493.8 at the strongest level of the day so far, and the Nifty50 climbed to as high as 17,438.5, up 56.5 points from its previous close.

A total of 37 stocks in the Nifty50 basket opened higher. Mahindra & Mahindra, Divi's, Bharti Airtel, Infosys and IndusInd were the top gainers.

HDFC Life, Kotak Mahindra Bank, HCL Tech, SBI Life, Grasim and Shree Cement — up around half a percent each — were also among the top blue-chip gainers.

On the other hand, ONGC, Britannia, Tata Consumer, Cipla, NTPC, Bajaj Finserv and Nestle — down up to one percent — were the worst hit among the laggards.

Reliance, Infosys, Larsen & Toubro, Bharti Airtel and Hindustan Unilever were the biggest contributors to the gain in both main indices.

The Nifty Bank — which tracks the performance of 12 major lenders in the country including SBI, HDFC Bank, ICICI Bank, Kotak Mahindra Bank and Axis Bank — rose as much as 0.3 percent in early deals.

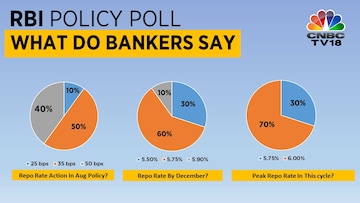

Half of the bankers in a CNBC-TV18 poll expect the RBI to announce a hike in the repo rate — the key interest rate at which it lends money to commercial banks — by 35 basis points later in the day.

"The RBI's rate action on Friday is unlikely to impact the market. The most likely scenario of a 30-35 bps hike is already known and discounted. The market will be looking forward to the RBI's commentary on inflation, GDP growth for the year ending March 2023 and macroeconomic indicators such as the current account deficit," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

"The momentum now is influenced by global cues and strong FII buying... FII buying in sectors like capital goods, FMCG, construction and power is likely to impart resilience to these segments," he said.

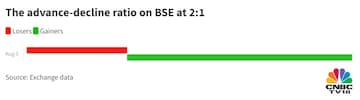

Overall market breadth was in favour of the bulls, as 1,733 stocks rose and 772 fell on BSE.

Global markets

Equities in other Asian markets began Friday in the green following a mixed session on Wall Street overnight. MSCI's broadest index of Asia Pacific shares outside Japan was up 0.6 percent at the last count. Japan's Nikkei 225 was up 0.7 percent.

S&P 500 futures were up 0.3 percent. The S&P 500 slid 0.1 percent and the Dow Jones 0.3 percent. The tech stocks-heavy Nasdaq Composite climbed up 0.4 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Two TMC activists injured in attack in Bengal's Cooch Behar hours before polling

Apr 19, 2024 12:09 PM

Lok Sabha Polls 2024: Here is how the markets fared in Modi government's second term

Apr 19, 2024 11:44 AM

Lok Sabha elections 2024: Dibrugarh braces for intense electoral battle

Apr 19, 2024 11:18 AM

Haridwar Lok Sabha elections: Tight contest between BJP, BSP, and Congress

Apr 19, 2024 10:33 AM