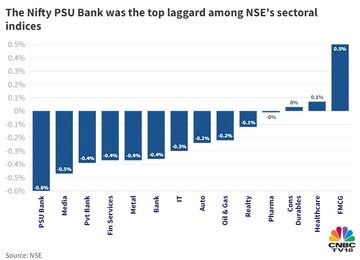

Indian equity benchmarks slipped into the red on Tuesday, halting a four-day winning streak, amid weakness across global markets as disappointing macroeconomic data from major economies reignited concerns about a recession around the globe. Financial, IT and metal shares were the biggest drags on headline indices.

Both main indices fell as much as 0.4 percent in early deals. The Sensex dropped 205 points to hit 57,910.5 at the weakest level of the day so far, and the Nifty50 slipped to as low as 17,268.2, down 71.9 points from its previous close.

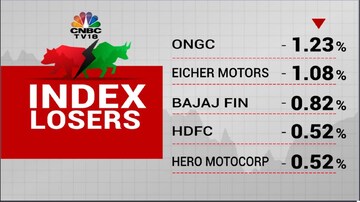

A total of 32 stocks in the Nifty50 basket began the day opened lower. ONGC, Eicher Motors, Bajaj Finance, HDFC and Hero MotoCorp were the top laggards.

Hindalco, IndusInd, Grasim, Axis Bank and Bajaj Finserv — down around 0.5-1 percent each — were also among the worst-hit blue-chip stocks.

On the other hand, ITC, Bharti Airtel, Nestle, Apollo Hospitals, Britannia, PowerGrid and Dr Reddy's, rising around half a percent each, were the top gainers.

ICICI Bank, Infosys, HDFC, HDFC Bank and Axis Bank were the biggest contributors to the fall in both Sensex and Nifty50.

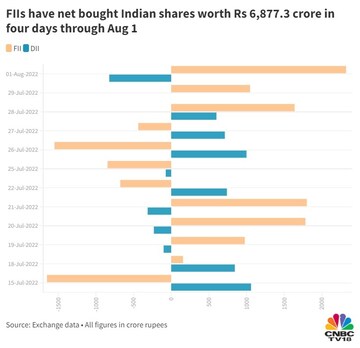

"A consensus that India will be the fastest growing large economy in the world this year, least vulnerable to a global growth slowdown, and the dollar index dipping to below 106 from the recent high of above 109 have paved the way for the return of FIIs, which have turned consistent buyers now," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

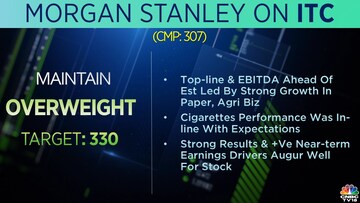

ITC shares rose as much as three percent to a 52-week high of Rs 316.7 apiece on BSE, a day after the cigarettes-to-hotels conglomerate reported a strong set of quarterly numbers.

ITC shares rose as much as three percent to a 52-week high of Rs 316.7 apiece on BSE, a day after the cigarettes-to-hotels conglomerate reported a strong set of quarterly numbers.

Analysts see more than seven percent upside in the ITC stock from Monday's closing price.

ITC's agriculture and FMCG units remain "very convincing as far as the outlook is concerned", Deven Choksey of KRChoksey told CNBC-TV18. "Definitely it has moved a little ahead of time. So to an extent, one will have to wait for some time, and correction would be a buying opportunity," he said.

The Zomato stock surged as much as 18.4 percent a day after the food delivery company reported a net loss of Rs 185.7 crore for the April-June period as against a net loss of Rs 356.2 crore for the corresponding period a year ago. Its revenue increased 67.4 percent on year to Rs 1,413.9 crore, according to a regulatory filing.

Overall market breadth was in favour of the bulls, as 1,895 stocks rose and 1,340 fell on BSE.

Meanwhile, the rupee continued to appreciate in a recovery from last month's all-time lows, beginning the day at a nearly one-month high of 78.85 against the US dollar.

Global markets

Equities in other Asian markets began the day in the red after data showing a slowing US manufacturing sector fuelled fears of a global recession. MSCI's broadest index of Asia Pacific shares outside Japan was down 1.7 percent at the last count. Japan's Nikkei 225 was down 1.6 percent.

S&P 500 futures were down half a percent, suggesting a weak start on Wall Street ahead a day after the index finished a choppy session 0.3 percent lower.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | PM's Rajasthan speech — has it anything to do with the post-poll mood of the first phase

Apr 23, 2024 3:45 PM

It's KGF 2024 and here's a look at the key characters in Karnataka

Apr 23, 2024 3:17 PM

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM