Indian equity benchmarks BSE Sensex and NSE Nifty50 began Wednesday's session in the green as trading resumed on Dalal Street after a day's holiday. Gains in financial, auto, healthcare and FMCG shares pushed the headline indices higher, though losses in IT counters limited the upside.

Globally, caution persisted among investors ahead of a key reading on inflation in the world's largest economy that would help in assessing the Fed's course of hikes in COVID-era interest rates ahead.

Both headline indices rose as much as 0.2 percent in the first few minutes of trade. The Sensex gained 131.3 points to touch 58,984.3 at the strongest level of the day so far, and the Nifty50 climbed to as high as 17,566.1, up 41 points from its previous close.

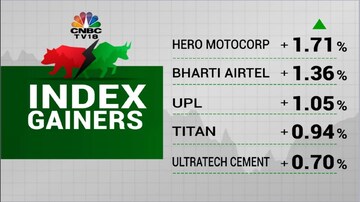

A total of 34 stocks in the Nifty50 universe started the day in the green, with Hero MotoCorp, Bharti Airtel, UPL, Titan and UltraTech being the top gainers.

Nestle, Tata Steel, ICICI Bank, Cipla and Bharat Petroleum — rising up to one percent each — were also among the top blue-chip gainers.

On the other hand, NTPC, PowerGrid, Asaian Paints, IndusInd and Grasim — down between 0.2 percent and 1.6 percent — were the worst hit among the laggards.

Bharti Airtel shares rose more than two percent, after the telecom operator's quarterly performance came in largely in line with Street estimates.

Investors awaited the last leg of earnings from India Inc for domestic cues.

"A major positive for India is FIIs, which have turned buyers and the buying momentum continues in August mainly because the dollar has stopped appreciating," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

Foreign institutional investors have remained net purchasers of Indian shares for the past eight days in a row — the longest streak since October 2021, according to provisional exchange data.

They have brought in a net Rs 11,125.3 crore into Street during this period.

He believes valuations on the Street have become expensive, which should keep the main indices from revisiting their highs.

"The Nifty is trading at around 20 times the estimated earnings for the year ending March 2023. High valuations will cap the rally," he said.

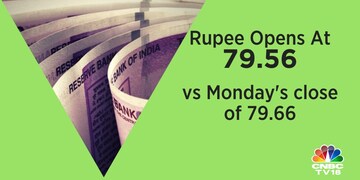

Meanwhile, the rupee edged higher against the US dollar. It is still within one percent of an all-time low hit last month.

Overall market breadth was largely neutral, as 1,438 stocks rose and 1,402 fell on BSE.

Global markets

Equities in other Asian markets were mostly in the red as investors awaited a key inflation reading from the US to assess the Fed's future course of hikes in COVID-era interest rates. MSCI's broadest index of Asia Pacific shares outside Japan was down 0.6 percent at the last count. Japan's Nikkei was down 0.7 percent.

S&P 500 futures were flat. On Tuesday, the three main US indices fell as a dismal forecast from Micron triggered selling pressure in tech stocks, with the Nasdaq Composite slumping 1.2 percent. The S&P 500 declined 0.4 percent and the Dow Jones 0.2 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM