Indian equity benchmarks began the last session of the trading week on a largely flat note, amid mixed moves across global markets, as Dalal Street headed into a long weekend. Gains in spaces such as banking and metal pushed the headline indices higher though losses in IT names limited the upside.

The Sensex gyrated within a 254.8-point range around the flatline, between 59,113 and 59,367.9, in early deals following a lacklustre start. The Nifty50 broadly moved within the 17,600-17,700 band.

A total of 25 stocks in the Nifty50 basket rose at the open. ONGC, Grasim, Hindalco, ICICI Bank and Hindustan Unilever were the top gainers.

Cipla, Shree Cement, Kotak Mahindra Bank, Britannia and Tata Steel — rising up to half a percent — were also among the top blue-chip gainers.

On the other hand, Apollo Hospitals, SBI Life, Infosys, Tech Mahindra, Wipro, HDFC, Bajaj Finance and IndusInd — declining between 0.2 percent and 1.8 percent — were the top laggards.

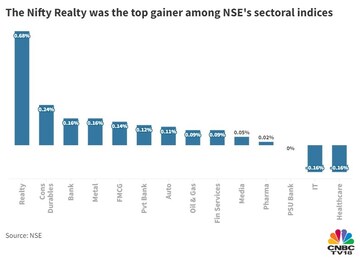

Barring IT and healthcare, most spaces saw mild gains.

"The rally is being driven mainly by two factors: the steady decline in the dollar index that is facilitating capital flows to emerging markets and the return of foreign institutional investors into the Indian market, which has completely changed the sentiment," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

As of Thursday, foreign institutional investors (FIIs) have net purchased Indian shares for 10 days in a row — their longest buying spree since January 2021. They made net purchases of Rs 12,164.6 crore during this period, according to provisional exchange data.

"The fact that India has the best growth story for this year and the next will impart resilience to the market," he said.

Broader markets saw mild gains, with the Nifty Midcap 100 and Nifty Smallcap 100 indices rising 0.2 percent each.

Overall market breadth favoured the bulls, as 1,894 stocks rose and 12,54 fell on BSE.

The market will remain shut on Monday for Independence Day.

Global markets

Equities in other Asian markets mirrored the mixed trend overnight on Wall Street, with MSCI's broadest index of Asia Pacific shares outside Japan flat at the last count. Japan's Nikkei 225 jumped 2.4 percent as the market resumed trading after a day's holiday. China's Shanghai Composite and Hong Kong's Hang Seng were down 0.1 percent each.

S&P 500 futures edged up 0.1 percent.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM