Indian equity benchmarks started Wednesday's session on a lacklustre note tracking weakness across global markets, as investors remained on the back foot ahead of a key gathering of central bankers at the annual Jackson Hole symposium this week.

Analysts expect volatility to persist in the market ahead of the expiry of monthly derivatives contracts on Thursday.

The Sensex dropped as much as 271.2 points or 0.5 percent to 58,760.1 and the Nifty50 slipped to as low as 17,525.5, down 52.1 points or 0.3 percent from its previous close.

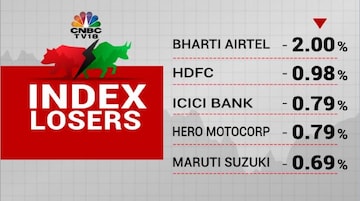

A total of 30 stocks in the Nifty50 basket slipped into the red at the open. Bharti Airtel, HDFC, ICICI Bank, Hero MotoCorp and Maruti Suzuki were the top laggards.

UltraTech, Hindustan Unilever, Bajaj Finance, SBI and Tata Consumer — falling around half a percent each — were also among the top blue-chip losers.

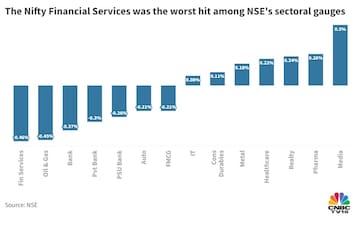

Losses in financial and oil & gas shares pulled the headline indices lower, though gains in healthcare and metal names lent some support.

"Steady buying by foreign institutional investors even in the middle of a strengthening dollar is significant from a market perspective. There is a near consensus that India will be an outperformer in the deteriorating global growth environment. FII inflows will be more country-specific than emerging market-oriented," said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

FIIs have so far in August net purchased Indian shares worth Rs 18,079.9 crore, according to provisional exchange data. Domestic institutional investors, on the other hand, have net sold equities worth Rs 6,352.9 crore.

Sustained buying by foreign institutional investors was the driving force behind a rally on Dalal Street that lasted 18-odd months till October 2021.

Most analysts believe the trend in the near term will be dictated by the Fed Chair's address at the Jackson Hole.

"If the Fed Chief sounds ultra hawkish, it would be a dampener for markets. If he sounds optimistic on the growth front and on containing inflation, it would be a bullish message," added Vijayakumar.

Overall market breadth favoured the bulls, as 1,913 stocks rose and 886 fell on BSE.

Global markets

Equities in other Asian markets succumbed to negative territory after a largely weak session on Wall Street overnight. MSCI's broadest index of Asia Pacific shares outside Japan was down 0.4 percent at the last count. Japan's Nikkei 225 and S&P 500 futures were down 0.3 percent each.

On Tuesday, the S&P 500 fell 0.2 percent and the Dow Jones 0.5 percent, and the tech stocks-heavy Nasdaq Composite finished flat.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM