India Inc, collectively, is on a growth path, but what’s driving this growth poses questions about the health of this trajectory, at least in the near term. We sifted through the reported fourth-quarter numbers of 269 companies in the BSE-500 index, to try and get a sense of how India Inc is growing. Here’s a glimpse of the findings.

GROWTH CONTINUES

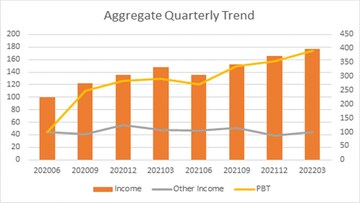

Our collection of 269 companies saw income grow 20 percent year-on-year and 7 percent quarter-on-quarter. Profit before tax (PBT) too grew 35 percent year-on-year and 11 percent quarter-on-quarter. Profitability, as expressed via PBT to Income, too remained steady at 14 percent. A near 400 basis point reduction in tax to PBT versus the average for the past three quarters, resulted in a higher 16 percent growth in PAT quarter-on-quarter.

So far, so good. But a closer look reveals that the post-COVID sharp growth seems to be easing off. On a year-on-year basis, income growth is down to Q4, following a steady decline in pace from 35 percent in the first quarter. Quarter one wasn’t a strong quarter, but the first quarter of 2020 was very weak. So, base effects worked themselves into the numbers. And there’s more base effect to play out this year.

The first quarter of the fiscal ending March 31, 2023, is likely to get a boost from the weak base effect of last year. So, in several sectors, the numbers could actually look quite good in quarter one, even though there may not be much to crow about on a normalised basis.

For those building in pessimistic numbers for the coming quarter, in light of the recent economic concerns, please be careful to not ignore the base.

Note: All numbers rebased to 100

Note: All numbers rebased to 100SECTOR VIEW IS MUDDIED

While the headline numbers seem to suggest all is hunky-dory, that’s not quite the case. A closer look at the sector performances reveals a picture of changing fortunes. Here are some glimpses of the internal picture.

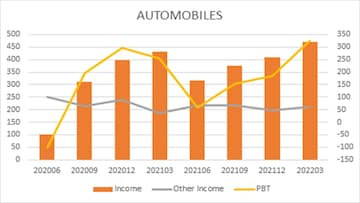

AUTOMOBILES

Autos seem to be finally driving themselves out of the ditch, having posted their strongest revenues, and by far their strongest profits, in the past eight quarters. Profits are up 31 percent year-on-year and 96 percent quarter-on-quarter. Even profitability is at a five-quarter high. This, and the recent softening of commodity prices, fuel duty cut and easing of supply chain challenges augur well for the future, though some demand-side challenges could emerge.

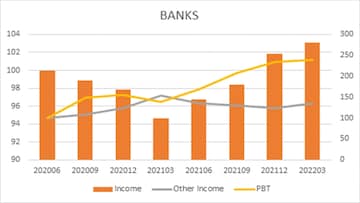

BANKS

Banks evaluated purely on the basis of income and profits have had a good quarter. Income has grown 9 percent year-on-year, though the sequential growth is less inspiring. Profits too are up sharply compared to the weak base quarter a year ago, though sequentially the growth has moderated to near 2 percent from 22 percent two quarters ago. The opening up of the economy seems to have aided credit growth, but whether this can sustain in a challenging backdrop remains the big question.

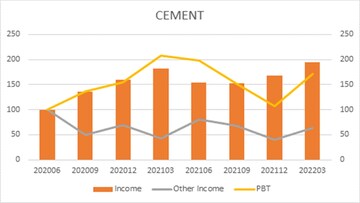

CEMENT

The picture for cement is mixed. While income has grown annually and sequentially, profits on a year-on-year basis are weaker, though they have seen a recovery from the previous quarter. Much of how the fortunes of the sector shape up depends on the prices they can command, even as the demand outlook seems favourable. On this, while cement makers have hinted at price revisions, the Government’s focus on containing cement prices, in its fight against inflation, may turn out to be a damper.

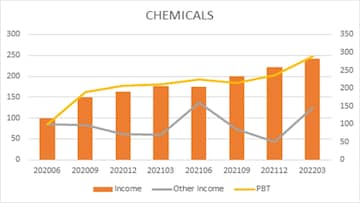

CHEMICALS

The sector is an amalgam of vastly differentiated businesses, but collectively the bunch has had a fairly good run. Barring the June quarter last year, income has grown sequentially each quarter over the past 7 quarters. Profits too have seen a steady climb, growing 26 percent year-on-year. Going forward, the performance is likely to vary with the mix of products and the ability to pass on / manage input cost pressures. So, it is best to look at such businesses separately rather than collectively.

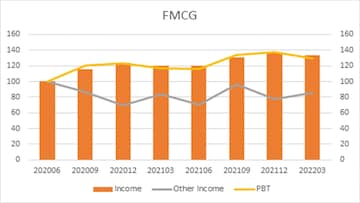

FMCG

Fast-moving consumer goods didn’t move as fast in the last quarter. Year-on-year growth has declined from near 20 percent in the first quarter to 11 percent, as the base effects wear off. Profitability too has been impacted a tad. The ability to manage costs and margins in a challenging demand environment is likely to determine the fortunes of players in the sector.

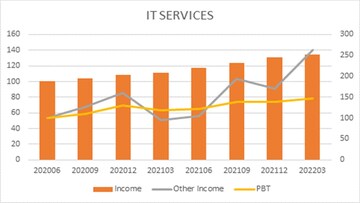

IT SERVICES

IT Services continued its secular, sequential growth, though the pace was weaker at 2.5 percent quarter-on-quarter compared to 5.8 percent in the preceding quarter, given the traditionally soft fourth quarter (2.5 percent in Q4-FY22 vs 2.3 percent in Q4-FY21 QoQ). Profitability, though, did see a hit, adjusted for the sharply higher other income.

High employee costs (hiring and attrition) seem to have been impacting these players, though the demand environment remains favourable. Rising stress in the startup world could help ease some of these pressures a few quarters down the line, but costs will need careful managing and those ahead of the curve on this will benefit.

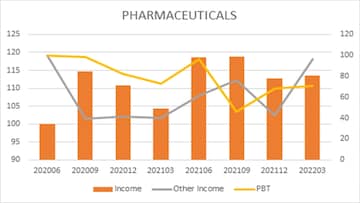

PHARMACEUTICALS

The one sector that’s been having quite a rocky ride is pharmaceuticals. Income and profits have seen big swings. The trajectory over the past eight quarters sums up the fortunes of the industry, which benefited in part due to COVID in some sections, lost out in some, and is now hoping to get back to business as usual, with the US FDA also resuming work in earnest. For those who don’t understand the sector well, it may help to wait and watch for some stability to emerge.

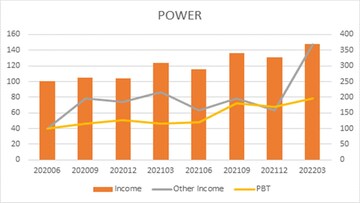

POWER

What’s a crisis for others, seems to be music for power producers. Income and profits are the highest in the past eight quarters, though a sharp jump in other income has aided profits in the last quarter. Profits have grown over 40 percent year-on-year for the past three quarters, and if demand trends don’t ebb significantly with the monsoons, expect more good times ahead.

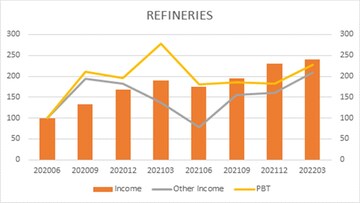

REFINERIES

The oil refining companies have seen a steady improvement in income over the past eight quarters, with the economy getting back on stream, post lockdowns. The profitability trend, though, has been erratic given several factors like gross refining margin trend, inventory gains & losses and marketing margin swings at play. The excise duty cut by the Government might now afford the oil marketing companies to pass on some more cost increases, benefiting the sector.

RETAIL

With cities opening up and malls springing back to life, the story for the retail sector has seen a significant change. Income is up 21 percent and profit 45 percent year-on-year. Income has nearly doubled from the June quarter and losses have turned to significant profits. The only concern for retail is inflation and a normalisation of the revenge buying bump.

STEEL

Steel companies have delivered a steady performance in the fourth quarter with income at the highest in eight quarters. Profitability, however, may be past the peak, at the lowest in the past four quarters, though still healthy. What’s more, much depends on what China does. The fortune of this sector is very closely tied to decisions by the Chinese, and that makes it vulnerable.

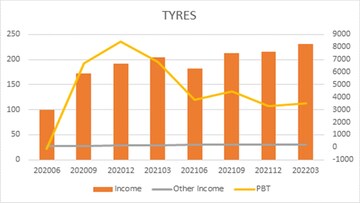

TYRES

The performance of tyre-makers seems to be tied closely to commodity prices. While incomes have seen a steady improvement post the COVID outbreak, profits have seen a divergent trend, with fiscal 2022 seeing a sharp decline. Rubber prices that were at near Rs 130 per kg in September last year, ended March at near Rs 160 per kg. Crude prices too have been on the boil, and that is unlikely to have helped.

THINK LONG-TERM

For investors, the decision to invest in a stock or sector should be driven by the long-term growth opportunity and prospects, not what short-term commodity cycles or demand-supply mismatches due to the fortunes of businesses. Given this, it helps to sift through the earnings to get a grip on its drivers and ask yourself the question whether these can stand the test of time.

From the above set, automobiles clearly stand out as a segment to keep an eye on.

(Edited by : Priyanka Deshpande)

First Published: May 22, 2022 12:02 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Elections 2024: Can BJP repeat its poll success in Uttar Pradesh? Here's a SWOT analysis

Apr 17, 2024 7:47 PM

Lok Sabha elections 2024: Know what all is closed on April 19 for phase 1 polling

Apr 17, 2024 7:35 PM

Lok Sabha elections 2024: From Nagpur to Chhindwara, key battles in Phase 1

Apr 17, 2024 7:19 PM