Financial stocks are doing better than the Indian benchmark, Nifty50, in the past month. The Nifty Bank has risen almost five percent in the past month versus the Nifty which has seen a 1.3 percent uptick in the same period. Pramod Gubbi, Co-Founder of Marcellus Investment Managers believes this will continue as banks and NBFCs (non-bank financial institutions) are the best play in the Indian economy currently.

“Financials is a big theme given that it plays into rising inflation and rising interest rates. We are clearly seeing benefit both in terms of loan growth as well as margin expansion for banks and better-funded non-banking financial companies (NBFCs),” Gubbi said.

Amongst all other emerging markets (EMs) relatively speaking India stands out because it is largely a domestic-driven market.

"From the capital reliability perspective, India has also become self-reliant," he said.

Foreign institutional investors or

FIIs emerged as net buyers of Indian shares after a gap of 10 months in August and according to Cameron Brandt, Director of Research at EPFR Global, this trend will continue at least in the short term

Gubbi believes that companies with pricing power will be able to pass on their input cost increases to their customers and keep their margins and returns on capital at sensible rates and more importantly, will come out stronger from this period of high inflation.

“Focus on high-quality businesses, quality defined as strong balance sheets, clean governance and high pricing part, you will emerge out of any adverse situation from a macro perspective, pretty stronger. And that's what's been our investment philosophy. Focus on protecting the downside, you'll eventually make money for investors,” he explained.

For the full interview, watch the accompanying video

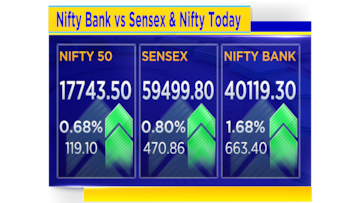

For a ball-by-ball commentary on how the markets are faring today (Sept 8, 2022), please click here (Edited by : Abhishek Jha)