Shares of Bandhan Bank fell more than 7 percent on Tuesday as concerns of a likely increase in non-performing loans resurfaced, considering the Assam floods.

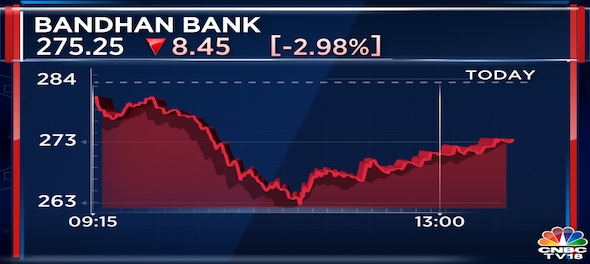

Around 1130 IST, shares of the lender fell to Rs 263.8 but regained later and were now trading 2.8 percent lower at Rs 275.65 on the BSE.

Severe floods have impacted Assam, one of the bank’s core eastern geographies which accounts for about 6 percent of the lender’s loans, according to a research note by Macquarie.

As per the brokerage firm’s analysis, the floods have impacted business in about 120 branches—one-third of Bandhan Bank’s branches in Assam. So, the affected portfolio should be limited to around 2 percent of overall loans.

Also Read |

Considering this, Macquarie is of the view that the Assam portfolio could continue to see elevated non-performing loans in the first half of FY23.

In the past three years, the stock has fallen close to 50 percent.

Jefferies had said last week that the Assam floods would have a near-term impact on Bandhan Bank's business as well as collections.

"While Assam is prone to such events, our conversations suggest this could impact the microfinance institution (MFI) business for the next 3-4 weeks, as 40 percent of the state has been materially affected by floods. Assam forms 6 percent of total loans and 9 percent of emerging entrepreneurs business (EEB) loans," Jefferies said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | PM's Rajasthan speech — has it anything to do with the post-poll mood of the first phase

Apr 23, 2024 3:45 PM

It's KGF 2024 and here's a look at the key characters in Karnataka

Apr 23, 2024 3:17 PM

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM