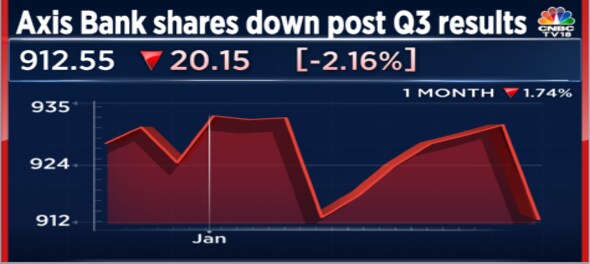

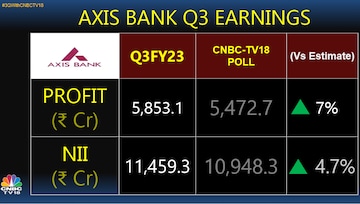

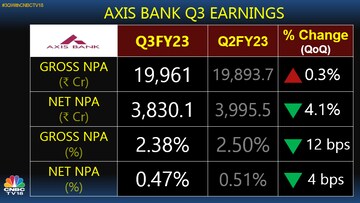

Axis Bank shares traded lower Tuesday even as analysts lauded the lender’s margin expansion and profit and net interest income beat in the October to December 2022 period. Several brokerages have raised their target price on the bank’s shares on the back of its margin that reached a 30-quarter high in the third quarter of the fiscal.

While other analysts said Axis Bank’s Q3 results checked all the right boxes, leading brokerage Macquarie has red flagged its loan growth in comparison to larger peers and weak liabilities franchise, meaning fewer retail deposits, as concerns. It, however, said the bank is well capitalised though there is a chance of capital raising by the end of Q4FY23.

Meanwhile, UBS, which gave a buy rating and has a target price of Rs 1,100 per share for Axis, pointed out that margin expansion and operating leverage drove Q3 beat and said that higher yielding loans were growing faster. The brokerage added that Axis management believes internal capital generation is sufficient to fund growth.

Also Read: HDFC Bank Q3 Result: Most brokerages maintain estimates after strongest NII growth in 14 quarters

Morgan Stanley noted that the private lender’s retail deposits, Liquidity Cover Ratio (LCR) — banks required to maintain a certain stock of High-Quality Liquid Assets (HQLA) to help it weather a stressful period — were in-line with HDFC Bank and ICICI Bank. Valuations, the brokerage said, looked attractive and that it assumes some moderation from current levels.

Bernstein, which has set a target price of Rs 1,000, too says that the December quarter results strengthen the case for a re-rating. It explained that strong growth in earning per share (EPS) is led by healthy margin expansion. It also lauded a healthy CASA led deposit growth (low cost deposits) and said that healthy fee growth would be the main positive while “tad slower” loan growth would be a negative.

CLSA, meanwhile, said better margin and lower opex led to more than 50 percent of core pre-provision operating profit growth. It, however, added that rising margin is an industry phenomenon while moderation in opex growth is a positive.

The brokerage also pointed out that the lender’s benign credit cycle continued and opex is heading in the right direction. Retail deposit mobilisation remains a key deliverable, the brokerage said, and raised its FY24-25 net profit estimate by 1-3 percent and expects RoE of more than 16 percent.

(Edited by : C H Unnikrishnan)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM