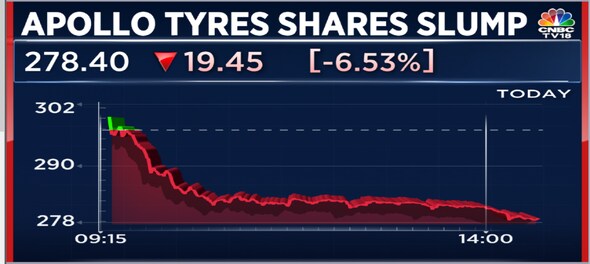

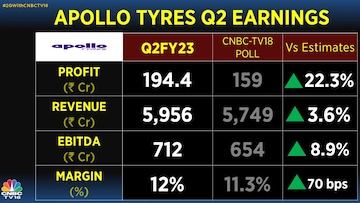

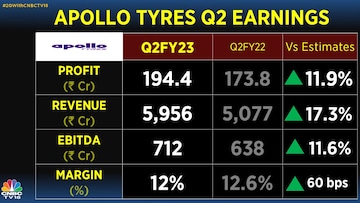

Apollo Tyres’ shares declined on Wednesday after hitting a 52-week high in the previous session as brokerages have a mixed outlook for the firm that announced its quarterly results, beating estimates, earlier this week. Apollo Tyres shares slipped more than six percent in intraday and were trading at Rs 279.25, down 6.2 percent from the previous close on BSE at 2:30 pm.

Brokerage firm Citi has given the company a buy call and raised the target price on its stock to Rs 340. This implies it expects a 14 percent upside in the stock from Tuesday’s closing price. Following an all-around beat in the second quarter of FY22-23, the brokerage has increased its consolidated earnings estimate by 5-11 percent over FY23-25.

Citi noted that Apollo Tyres’ India business is steady and that the company’s focus is on market share gains and premiumisation in EU business.

Morgan Stanley has an overweight call on the company with a target price of Rs 329 per share as it believes its quarterly earnings were largely in line with projections. It continues to grow ahead of the market and gaining market share in India and Europe, it brokerage said, adding that improving margin, FCF and return ratio profile to support rerating.

However, Nomura has downgraded the firm to neutral and set the target price at Rs 327 as it is of the view that replacement demand remains slow and that the firm’s rising working capital (WC) debt will likely delay expected net debt reduction to Rs 3,900 crore by FY24.

According to the brokerage, Apollo Tyres' valuations are factoring in commodity tailwinds. It has raised its cons EBITDA estimate for the tyre firm by 4 percent and 2 percent and EPS by 6 percent and 3 percent for FY24 and FY25, respectively.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM