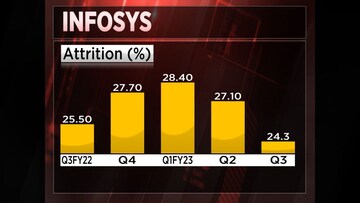

Net addition of employees in the quarter reported took a hit, slipping to 1,627 from over 10,000 in the previous quarter of the fiscal. However, its

attrition rate has come down to 24.3 percent from 27.10 percent in this period.

Here is an edited excerpt of an interaction with the company's CEO, Salil Parekh who spoke about the road ahead for the technology bellwether.

Q:

First on your revenue guidance - What is the reason for the revision while you were talking about slower growth? What this would mean for the fourth quarter now? Does it imply a muted fourth quarter?

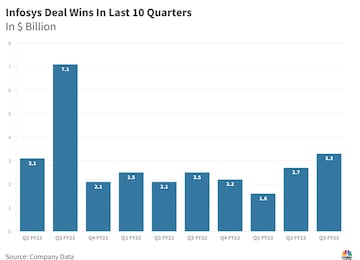

A: So on the guidance, we've had very strong large deals for this for quarter three, and we've had very strong growth in the quarter of 13.7 percent. Keeping those factors in mind, and also looking at the points where some of our industries, we're seeing a different economic environment, for example, in financial services, mortgages or investment banking, in telecom companies, in hi-techs, retail and all - keeping all of those factors in mind, we've increased the guidance.

Specifically, regarding quarter four, we don't provide a quarterly view of that, we only have annual guidance,

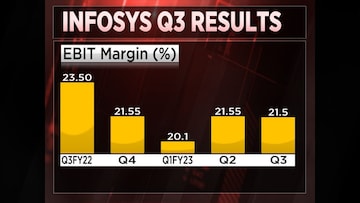

Q: That is right but the implication is because you have revised up the guidance for the rest of the year, will we see a bit of a muted growth? And also, if you could comment on the EBIT margin? Do you expect it to be at the lower end of what you guided?

A: Typically, quarter three and quarter four are seasonally weak quarters for Infosys in any case. So those factors still continue. On the margin, we had a very good operating margin in quarter three at 21.5. We've kept the guidance, which was narrow to 21 to 22. We've kept it at that level and we've also made the statement in the comments earlier, it'll be at the lower end of the guidance.

Q: While you do not give any guidance for the following year, FY24, what is the feedback you're getting from clients amid the macro trends that we're seeing? There were large deals wins, you won 32 large deals in the quarter, will that kind of deal win rate continue?

A: Our pipeline for large deals is strong today. We have two engines of growth, one is on digital and cloud and one is on automation and cost efficiency. So depending on how the environment changes, and it's different industry by industry, we feel that we are well positioned to sort of help our clients in both dimensions. So we continue to see that as the approach.

At $3.3 billion, Infosys' deal wins in Q3 were the strongest in the last eight quarters.

Q: You've already flagged off certain sectors where you expect some sort of weakness. Hi-tech, telecom, retail, BFSI. How long do you expect that to continue? And when do you expect things to improve?

A: We have not put a timeframe on that. We've not talked about what we've seen in quarter three and as things evolve in either direction, we will start to talk about it.

Q: How do we read your hiring figures? You've guided for 50,000 fresh hiring for the year, you are at close to 46 now, but it has come down quarter on quarter. Are you expecting slower growth? Should we read it as that?

A: There again we don't have any view that we share on the growth for FY24. Our focus really is on the guidance and the growth for this year, which will end in March.

Q: And attrition is now at a five-quarter low. Do you expect that trend to sustain? Or has that been a one off?

A: Attrition as you point out is going down every quarter for us. There were several policies that we put in place, several changes, much more aligned with the employee expectations, their career development, their training, and many of those things, I believe, are helping us with very sharp six-point reduction attrition this quarter, but also in the previous quarters.

Q: Final word on margins as well. Despite this kind of rupee depreciation, margins have remained flat. Any outlook you could give us for the coming quarters?

A: On the margin, I think we have the guidance for this financial year. But beyond that, we don't have a guide for the next financial year on the margin.

For the entire interview, watch the accompanying video

(Edited by : Abhishek Jha)

First Published: Jan 13, 2023 11:52 AM IST

At $3.3 billion, Infosys' deal wins in Q3 were the strongest in the last eight quarters.

At $3.3 billion, Infosys' deal wins in Q3 were the strongest in the last eight quarters.