Glenmark Pharmaceuticals on Friday said that the company expects to maintain historical margin level of 19 percent for the current financial year after cost pressure impacted its earnings in the first quarter (Q1).

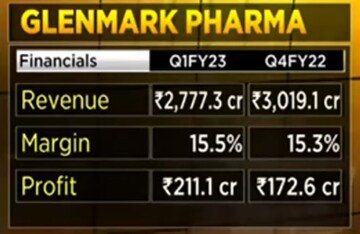

The company reported its Q1 earnings with both revenue and margin coming in below estimates. While the revenue stood at Rs 2,777.3 crore versus Rs 2,964 crore, margin was at 15.5 percent versus 19.3 percent, on a year-on-year basis. Profit After Tax (PAT) was at Rs 211.1 crore as compared to Rs 306.5 crore a year ago, down 31 percent but up from Rs 172 crore in the last quarter.

“Our margin - while it came at about 15.5 percent, it was a reasonable quarter considering some of the challenges. Last two years we have been at about 19 percent (in margins). For the full year, we feel that we should be pretty close to those numbers,” VS Mani, Executive Director and Chief Financial Officer, Glenmark Pharma, said in an interview with CNBC-TV18.

"The company faced some supply chain disruptions due to the overall geopolitical situation as well as some other challenges in terms of logistics, etc.," he added.

Glenmark Pharma has 10-12 launches coming up during the course of this year. “All this should help to reach where we closed last year,” said Mani, adding that the company has guided for a revenue growth of 6-8 percent for FY23.

While the company's India business growth was strong at 17 percent sequentially at Rs 1,035.2 crore, the North America business witnessed a fall of 10.2 percent to Rs 662.8 crore.

"India's business has been doing well for quite some time.... We see the year at a strong growth of about mid-teens happening during the year,” said the CFO.

On debt, he mentioned, “This broadly went up largely on account of basically the currency move. Also in this quarter, we refinanced some of our foreign currency convertible bonds (FCCBs). So obviously, while we had accrued the premiums over the years, there was a one-time big number that we paid off in this quarter. So going forward this year, we should definitely see a decent reduction in our debt."

The company hopes that its subsidiary for drug discovery and development operations Ichnos Sciences closes at least one licensing deal before the end of the year.

The stock closed flat at Rs 389 per share on BSE. It is up 4.65 percent in the last five days and 3.95 percent in the past month.

For the full interview, watch the accompanying video