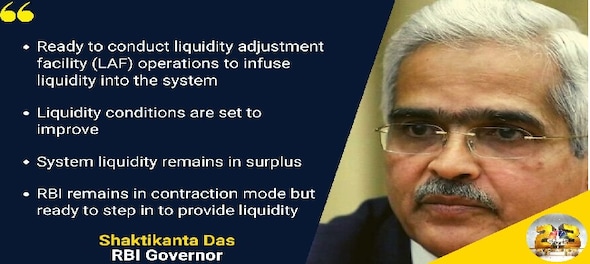

The Reserve Bank of India (RBI) is ready to conduct Liquidity Adjustment Facility (LAF) operations to infuse liquidity into the system, governor Shaktikanta Das said while making Monetary Policy Committee (MPC) announcements. He said that liquidity conditions are set to improve, and the weighted average lending rate is up 117 bps in May-October.

"The system liquidity remains in surplus. RBI remains in contraction mode but ready to step in to provide liquidity," Das said.

"The RBI remains nimble and flexible in its liquidity management operations. So, even though the RBI is in absorption mode, we are ready to conduct LAF operations," he added.

India's banking system liquidity slipped into deficit in October but improved in recent weeks amid heavy government spending. Daily banking system liquidity surplus has averaged Rs 1.59 trillion so far in December, up from around Rs 500 billion in November.

Meanwhile, RBI has raised the benchmark lending rate by 35 basis points to 6.25 percent to tame inflation. This is the fifth consecutive rate hike after a 40 basis points increase in May and 50 basis points hike each in June, August and September. In all, the RBI has raised the benchmark rate by 2.25 percent since May this year.

The six-member Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das decided by majority view in favour of the rate hike.

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 6.7 percent in October. Retail inflation has been ruling above the RBI's comfort level of 6 per cent since January this year.

The RBI has slashed its GDP growth forecast to 6.8 percent from an earlier estimate of 7 percent for the current fiscal.

First Published: Dec 7, 2022 10:53 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha election 2024: A SWOT analysis of DMK vs AIADMK in Tamil Nadu

Apr 19, 2024 1:22 AM

Exclusive: FM Nirmala Sitharaman says poverty alleviation can't be achieved by throwing money at the problem

Apr 18, 2024 7:27 PM

Tamil Nadu Lok Sabha elections 2024: List of Congress candidates

Apr 18, 2024 4:33 PM

Will the payment under PM-KISAN be increased? Here's what Finance Minister said

Apr 18, 2024 3:58 PM