Inflows in equity mutual funds have dropped by 42 percent to Rs 8,898 crore in July amid volatile market conditions, data released by the Association of Mutual Funds in India (AMFI). Although, this was the 17th straight month of positive inflow in equity schemes.

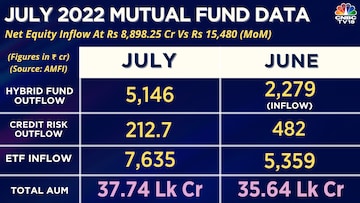

The total assets under management (AUM) for the mutual fund industry rose to Rs 37.74 lakh crore as of July 31, 2022, compared to Rs 35.64 lakh crore. The debt funds witnessed net inflows of Rs 4,930 crore in July compared to net outflows of Rs 92,247 crore in the previous month, the data showed.

Contribution through systematic investment plans fell marginally to Rs 12,140 crore in July compared to Rs 12,280 crore in the previous month.

All the equity-oriented categories received net inflows in July with the Small Cap Fund category being the biggest beneficiary with a net inflow of Rs 1,780 crore. This was followed by the Flexi Cap Fund fund that witnessed Rs 1,381 crore net infusion.

Besides, Large Cap Fund, Large and Mid Cap Fund and Mid Cap Fund witnessed over Rs 1,000 crore net inflow each. Apart from equity, debt mutual funds witnessed an inflow of Rs 4,930 crore last month after witnessing a net outflow of Rs 92,247 crore in June.

However, Gold Exchange Traded Funds (ETFs) experienced a net outflow of Rs 457 crore, which was in sharp contrast to a net infusion of Rs 135 crore seen last month. Overall, the mutual fund industry registered a net inflow of Rs 23,605 crore during the month under review as compared to a net withdrawal of Rs 69,853 crore. This was mainly on account of higher levels of redemptions from debt mutual funds.

Commenting on the same, Akhil Chaturvedi, Chief Business Officer, Motilal Oswal AMC said, "July seems to be month where investors have taken some profits off as markets went up. The net sales in equity plummeted to Rs 8,898 crore versus Rs 15,497 crore, momentum was coming down all through last few months as the markets were correcting but July was a steep fall and excluding SIP numbers, we might have witnessed actual net negative sales in July."

"Even the hybrid category has slowed down with both dip on gross sales and higher redemptions. We are seeing markets recovering and FII returning although early days to say that this trend will be consistent but if it is then I hope for the retail investors confidence return once again," he added.

(Edited by : Anshul)

First Published: Aug 8, 2022 6:00 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM

West Bengal Lok Sabha elections: Abhishek Banerjee to Mahua Moitra, a look at TMC's candidates

Apr 19, 2024 6:14 PM

Chhattisgarh Lok Sabha elections 2024: Bhupesh Baghel among the list of Congress candidates

Apr 19, 2024 3:45 PM

Chhattisgarh Lok Sabha elections 2024: Full list of BJP candidates

Apr 19, 2024 1:46 PM