The department of financial services has proposed some important amendments to the Insurance Regulatory and Development Authority of India (IRDAI) act as well as the Insurance Act and sought comments on this by December 15.

For the Insurance Act, the department of financial services has proposed that the issuance of composite licenses should be approved.

What is a composite license?

A composite license is a common license through which a life insurance company can undertake the entire general insurance business or standalone health insurance business or even choose one business out of it.

At the same time, it works the other way around as well. Where general insurance companies can enter into the life insurance business as far as that composite license receiving it from the regulator is concerned.

Product Distribution

It's proposed that insurance companies be allowed to distribute other financial products. These other financial products can be something like mutual funds, loans or insurance products of other streams, i.e. for life, it could be distributing general insurance products and vice versa.

This will open up a new business and a revenue stream for insurance companies, but the regulations here will be subject to what the IRDAI decides at that time, once it gets approved.

Minimum capital for new insurance companies

Currently, there is a condition that health, general and life insurance companies have to show Rs 100 crore as minimum capital. Now, the minimum capital will be decided based on the size and the scale of the operations of the new insurance company and that will be decided by the regulator.

Stake acquisition

Currently, if an entity owns about 5 percent of an insurance company, it has to get the insurance regulators' approval for any further buying. Now, that approval won't be required till another 5 percent.

Finally on captive reinsurance, now the insurance companies will be able to serve as a captive reinsurance company for their holding company taking in their entire business on their books.

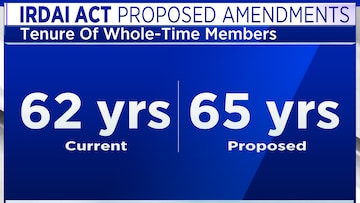

As far as the IRDAI act is concerned, the department of financial services has proposed that the whole time members of the insurance regulatory body hold office longer.

(Edited by : Abhishek Jha)

First Published: Dec 1, 2022 2:24 PM IST