Private banks are going old school — they are on a branch expansion spree at a time when the buzz is digitisation. The retail loan has been the dominating flavour for the banking sector over the last few quarters with corporates turning down bank loans and moving over to money markets or capital markets (fundraising), as rates were low and they wanted to deleverage their balance sheet.

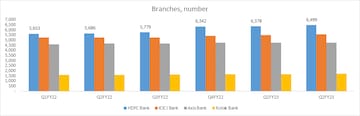

Branch expansions

Let's take a look at the branch expansions by the top private banks in the last five quarters. Private lender HDFC Bank has 846 branches (+14.3 percent growth), ICICI Bank has 346 branches (+6.4 percent growth), Axis Bank has 160 branches (+1.73percent growth) and Kotak Mahindra Bank has 98 branches (+5.43 percent growth).

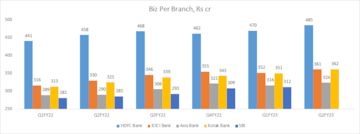

This has helped the business momentum of the banks. From the first quarter of FY22 to the second quarter of FY23, business per branch has grown by 5.9 percent for HDFC Bank, 9.44 percent for ICICI Bank, 11.59 percent for Axis Bank, and 11.53 percent for Kotak Mahindra Bank.

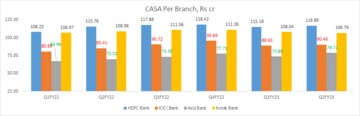

But deposits or current and savings accounts are what a bank targets while opening a branch — in the context of the recent spike in deposit rates this is an important metric to track.

Banks have seen a rise in the current account and savings account (CASA) mobilisation and the growth is led by Axis Bank, ICICI Bank, and HDFC Bank. Kotak Mahindra Bank is the only bank to witness a decline in CASA per branch over the last few quarters.

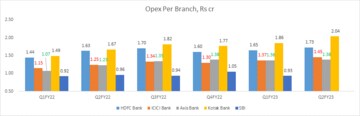

Branch expansion always comes with a cost and the bank that manages this better gains an edge. HDFC Bank, despite having the highest number of branch openings, has seen the lowest rise in cost per branch

Between the first quarter of FY22 to the second quarter of FY23, cost per branch increased by 19.64 percent for HDFC Bank, 26.85 percent for ICICI Bank, 29.02 percent for Axis Bank, and 36.72 percent for Kotak Mahindra Bank.

But, branch expansion also aids in loan growth. Market share has risen massively for HDFC Bank over the last five quarters (113bps), followed by ICICI Bank (by 62bps) and Axis Bank has seen a market share gain of just 12bps.

So, why the branch expansion?

The retail portfolio needs feet on the street and nearness to customers. This has also aided market share gains, as banks draw customers away from NBFCs. It also aids them in sustaining a healthy CASA ratio.

Outlook

Despite digital transactions increasing, private banks' focus on branch expansion may seem like a surprise. The recent rush for deposits by PSU banks suggests private banks may have seen this coming. With a liquidity crunch and banks focused on loan growth, branch expansion will aid business momentum.

(Edited by : Abhishek Jha)

First Published: Nov 23, 2022 3:35 PM IST