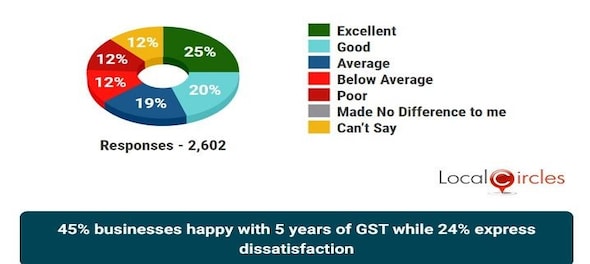

The Goods and Services Tax (GST) has completed its five years of implementation after the 101st constitutional amendment. There have been many accounts of dissatisfaction with the GST's structure or problems faced as per filings. But according to a recent survey, almost 45 percent of businesses gave the present GST regime a thumbs up while about a quarter expressed dissatisfaction.

Local Circles surveyed 12,000 respondents from 2,400 businesses in 170 districts of which 47 percent of the respondents were from tier 1 cities, 32 percent from tier 2 and the remaining from tier 3-4 cities and rural districts.

Also read: View: Five years of GST and the road ahead

So, what is making these the quarter of respondents expressing dissatisfaction? The surveyors did a little deep dive.

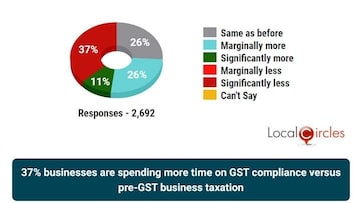

Time spent on GST compliance

Filing of indirect taxes was mostly done once a month or quarter before the new tax structure kicked in. So, the first question to businesses was: “How much more time are you spending on GST compliance versus pre-GST business taxation?”

The response here was mixed as 37 percent of respondents said they were spending more time while an equal percentage of respondents said they were spending less time. But the rest said it was taking the same amount of time as it did earlier.

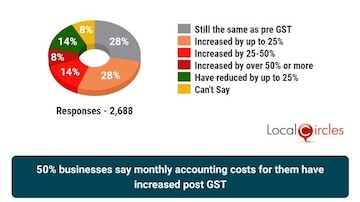

Have monthly accounting costs increased?

A business with over Rs 2 crores of turnover has to maintain accounts like purchases, sales, and stock under the new GST regime. So, the next question was: “How much have your monthly accounting costs increased post-GST as compared to the pre-GST?”

While half of the respondents said monthly accounting costs increased, 14 percent of businesses said they had reduced. There were also 28 percent of businesses who said that it remained the same as pre-GST.

Also read: On This Day: GST came into effect in India, SBI was founded and more

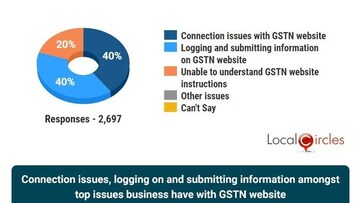

Issues with GSTN website

Connection issues, logging on and submitting the information were among the top issues businesses had with the GSTN website. When asked “What is currently the top difficulty faced by your business/company in filing GST returns?”, 40 percent of respondents said logging on and submitting information on the GSTN website was the biggest issue.

Infosys was awarded a Rs 1,380-crore contract in 2015 to build and maintain the GSTN website. It was recently asked by the government to fix problems with the portal at the earliest.

Meanwhile, a lot of businesses, 20 percent to be exact, were still unable to understand the GSTN website, as per the survey.

Invoice matching another top issue

Technological glitches were not the only problem taxpayers faced, as per the survey. The majority of businesses, 75 percent to be exact, said their top issue with GST was invoice matching between outputs and inputs.

The GST Council has sought to address these concerns and on average the Council has met nearly nine times a year.

Also read: Online gaming industry may become unviable if 28% GST is applied on overall pool value, say experts

First Published: Jul 1, 2022 10:49 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Every student suicide pains me, I will try better: BJP Kota MP Om Birla

Apr 16, 2024 2:19 PM

Bihar Lok Sabha elections 2024: Schedule, total seats, Congress candidates and more

Apr 16, 2024 1:02 PM

Lok Sabha polls: BJP drops Som Parkash, fields Abhijit Das against Mamata's nephew

Apr 16, 2024 12:49 PM