Oil prices eased slightly, but Brent continued to hover around $95 a barrel on Tuesday after the Organization of Petroleum Exporting Countries and allies (OPEC+) led by Russia decided to marginally reduce production by 100,000 barrels a day, which accounts for only 0.1 percent of global demand.

This means oil supplies will be back at the August 2022 levels. OPEC+ decided to reverse the 100,000 bpd increase for September after top producer Saudi Arabia and other members voiced concerns about the slump in prices since June despite tight supply.

According to Sumit Pokharna, Vice President - Fundamental Research, Kotak Securities, though this is a small reduction,

crude oil and gas prices are already at elevated levels.

“We expect crude oil to fall in the medium term given concerns of tightening monetary policy, COVID-19 curbs in parts of China, global economic growth slowdown, etc. can dent oil demand going forward. We need to see how soon geo-political situation normalises,” he told CNBCTV18.com.

Commodities expert Ajay Kedia, too, thinks this move means OPEC needs to support oil prices, as they revealed last month. At the same time, the impact is less as fear of slowdown and COVID-19 concerns in China may continue to impact the energy market.

He expects Brent to remain in the average range of $90 to $95 a barrel.

What does an oil output cut mean for India?

India, the world's third-largest crude oil importer, imports around 85 percent of its crude to meet its oil requirements.

Kotak Securities’ Pokharna explained that oil prices are already high, and a further rise in prices increases imported inflation and adversely impacts current account deficit (CAD) and fiscal deficit.

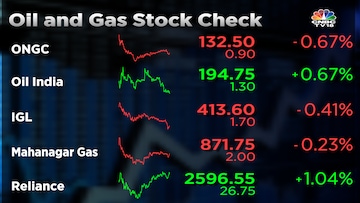

He said that higher crude oil prices are positive for upstream oil exploration companies like Oil and Natural Gas Corporation (ONGC), Oil India, etc. However, the profitability of these companies will depend on

government policies, he said.

He added that given the concerns about policies, Kotak Securities is not bullish on the public sector upstream i.e. exploration and production companies.

The brokerage is positive on city gas distribution companies like Indraprastha Gas (IGL) and Mahanagar Gas.

“Given the government's thrust on less pollution fuel, focus on developing city gas distribution in India, higher gas allocation to the sector, pricing freedom, etc., we believe these companies should do well in the medium to long term,” Pokharna said.

India to continue to buy oil from Russia

Petroleum Minister Hardeep Singh Puri has said that India would carefully assess whether to support a G7 proposal to impose a cap on the price of Russian oil as there are many factors to consider before making that decision.

"There is a

shortage of supply, demand is higher than supply, OPEC has today decided to circumscribe its production by 100,000 barrels, there's a talk on the price cap, there are a lot of things," he told CNBC International at Gastech 2022 in Milan, Italy.

India, apart from having a population of 1.4 billion, consumes 5 million barrels of oil daily, he said, adding that there are 60 million people who go to a petrol bunk daily to fill up.

"I have a

moral duty to my consumer. As a democratically elected government, do I want a situation where the petrol bunk runs dry? Look at what's happening in countries around India," he said, asserting that India will buy oil from Russia as it's a question of energy, which is not sanctioned.

During the pandemic, the price of oil went down to $90 a barrel, then it went up to $120 plus a barrel, and then there was the Russia and Ukraine factor. "The world is adjusting to all that. Now, what will a proposal mean? We will look at it very carefully. Who will be the participants? What will be the implications, etc.?” he said.

Puri said India consumes around 5 million barrels of oil per day, largely coming from Iraq, Saudi Arabia, Kuwait and the United Arab Emirates. Russia accounted for just 0.2 percent of India’s oil imports at the end of March, noting that some criticized India for increasing its supply of Russian oil following the invasion of Ukraine.

“I said the Europeans buy more in one afternoon than I do in a quarter. I’d be surprised if that is not the condition still. But yes, we will buy from Russia, we will buy from wherever,” Puri said.

Meanwhile, reports suggest India will consider backing the United States' proposed price cap on Russian crude only if supplies from Venezuela and Iran are assured.