The IT sector continues to be one of the biggest recruiters, attracting talent from the country. But the fight is becoming tough by the day.

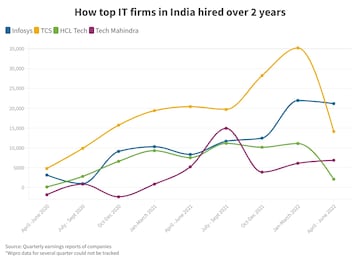

In the first quarter of 2022-2023, India’s top five tech companies — Infosys, Wipro, Tata Consultancy Services (TCS), HCL Tech, and Tech Mahindra — added a combined headcount of more than 59,700.

But this was much lower than employees hired in the preceding two quarters — 65,011 in the October-December period and 85,820 in the January-March quarter of FY22.

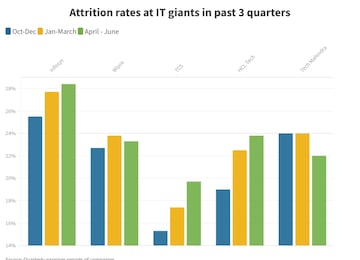

This is at a time when attrition remains high for three out of the five companies, and HRs across the industry have been suggesting that they want the right talent, not just more headcount.

The top five IT companies are undertaking programmes to add another 100,000 people to their workforce this year.

“Since the market is humongous for the IT contenders, HR departments must prepare this year for a non-stop war for skill,” Siva Prasad Nanduri, the chief business officer of TeamLease Digital, told CNBC-TV18.com.

Jang Bahadur Singh, director and industry lead - technology, Human Capital Solutions at Aon, thinks the COVID-19 pandemic proved as an accelerator, pushing firms to scale digital capabilities across sectors from financial services to retail to e-commerce, etc.

This meant a huge windfall for IT services and consulting firms such as TCS, Infosys, etc. Most of these firms were not staffed to cater to such a huge uptick in demand, and with a downsized bench, he explained that they had to aggressively buy talent.

"Further record high attrition at an average of 24 percent and above in this space put more pressure on talent acquisition, which is reflected in metrics such as offer decline rates, increases offered to new joiners, etc.," he said.

Also Read: What Wipro is doing right to ease attrition issues — other IT firms might want to take notes

Nanduri said in 2021, the tech job market was already tight. There were more job openings published than candidates available.

“2022 will not be any easier. More companies have started using Artificial Intelligence and virtual recruiting tools, focusing on diversity, equity, and inclusion and moving their talent acquisition efforts to remote candidates,” he said. Nanduri also pointed to the rise of gig workers.

Singh said he had observed a twin-pronged strategy for IT hiring in a challenging environment. In the short term, the IT firms have aggressively bought lateral, skilled talent and have been willing to a pay premium for the same, he said.

Additionally, he said that firms have gone aggressive on campuses, with large players hiring north of 50,000 freshers as part of a long-term build phase. "We also see firms reinvesting in building a ready bench of talent to mitigate future such supply challenges."

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Issues raised by Prime Minister Modi have not resonated with people of Tamil Nadu, says Congress

Apr 19, 2024 11:38 PM

West Bengal Lok Sabha elections 2024: A look at Congress candidates

Apr 19, 2024 8:45 PM