Indian students who have gone to the United States after taking hefty education loans — at least Rs 30 lakh — find themselves with the short end of the stick. A weakening Indian rupee and soaring inflation in the US have forced many to add to their debt just to keep themselves afloat.

The rupee hit its lowest level at 80 against the dollar index on Tuesday. Students are considering availing top-up loans or increasing their education loan amount to be able to afford the rising cost of living in the US, said Ankit Mehra, CEO and co-founder of GyanDhan, an education financing marketplace.

Mehra told CNBCTV18.com that students are looking for top-up loans of up to 10 percent of the principal. In absolute terms, they need an extra Rs 2 to Rs 10 lakh, averaging at about Rs 5 to Rs 6 lakh for most students, he said.

Why do students still want to study abroad?

Education consultant Athena Education said its recent batch of scholars is headed to college this year as intended and that inflation is not a barrier.

The company's co-founder Poshak Agrawal believes that such financial cycles are bound to recur, but the quest for knowledge is a constant. The intellectual depth, network, and weightage that immersive learning brings must be looked at. Inflation is a temporary factor; education from an elite university is an asset for life, he said.

“On the one hand, the dollar's value with respect to the rupee increases the cost of education marginally for the parents paying for their child’s tuition fee, living expenditures, food costs, etc.

"However, on the other, for so many scholars who have graduated and have jobs in the US or are interning, their purchasing power has risen. They can support their Indian family more with the same dollars earned. Their salaries and stipends have greater power now,” he said, explaining the proof of return on investment.

The GyanDhan CEO too indicated a robust demand by students to study in the US as his organisation is still getting a similar number of financing applications and inquiries as before the rupee started to sink.

“We have seen a significant increase in the number of students targeting studies in the US. The COVID-year saw a contraction, but since then volumes have picked up dramatically, he said.

| Year | Growth rate in loans at GyanDhan |

| 2020 | -25.51% |

| 2021 | 267.09% |

| 2022 (YTD) | 140.81% |

| Source: GyanDhan | |

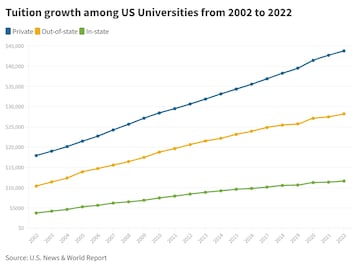

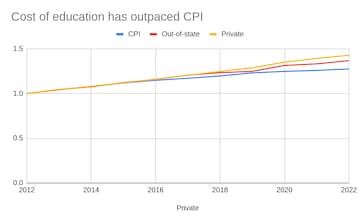

This, even as data shared by GyanDhan shows university costs have outpaced inflation even in recent years.

Source: GyanDhan

Source: GyanDhanParents back home feel the inflation heat

Another dilemma that Indian learners in the US are facing is whether to avail an additional loan or delve into savings to have sufficient money to fund their stay in the US and fulfill their dream of studying abroad, according to the GyanDhan co-founder. The cost of education is increasing in the second year, as opposed to the first year as of now, he said.

Roopali Birman, Head of Counseling, iSchoolConnect, also said that parents are worried about the rising financial load. Overseas education costs have increased by 25 percent in the last six years, she said, adding "high-interest rates on education loans coupled with hiked spending due to the sinking rupee value are adding to their financial woes".

According to Birman, discouraged by the unaffordability of higher education abroad, "many aspirants are turning to domestic colleges".

Saurabh Arora, CEO & founder of University Living, a global student accommodation marketplace, said rupee depreciation is never good, especially for an import-driven country like India.

He said students residing in the US who are being funded by their parents from India are facing some difficulties in paying for accommodation and other expenses as their purchasing power is decreasing. The Indian parents are depositing higher amounts but the students based in the US are receiving a lesser value, which is becoming challenging, he explained.

"Currently, the students are required to pay second instalments on the rent and the rupee depreciation might create challenges and the same is the case with loans and their interest rates," Arora told CNBCTV18.com.

Akshay Chaturvedi, Founder & CEO, Leverage Edu, suggests that students can draw loans in India in INR and pay the entire tuition fee off in a single go to avoid any forex fluctuations later.

According to him, students don't simply make destination choices on comparatively small changes in their overall expenditure. They know it's an investment into their future and they are fully focused on making the most out of this opportunity, he said.

Chaturvedi said his firm is also assisting students in opening bank accounts in destination countries that store foreign currency before students arrive, making those funds unfettered in case there is a global currency flux.

Some students take the ‘extra class’ route

Devina Aggarwal, who is pursuing an undergraduate degree in economics from Yale University, said she finished her spring semester in May this year and there was a massive difference in her expenses as compared to those she incurred during the fall semester that ended in December.

She said she was having to spend extra on basic essentials, and cut back on eating out frequently, and other leisure activities. “If I was spending say, Rs 20,000 for my personal expenses in the first semester, in the second one I was spending close to Rs 30,000 to Rs 35,000,” she said.

The 20-year-old, though didn’t take an education loan, said her parents are now feeling the pressure as they need to submit the hiked fee for the second year of college that starts in August.

Aggarwal is taking part in orientation programmes for freshers, for which she’ll be paid close to $300-400 a week, and is also taking Hindi classes to earn some extra cash.

Are there enough jobs though?

The question that then arises is whether students are able to find suitable jobs and salary packages via campus placements and other mediums such that they’ll be able to make up for the additional borrowings.

Mehra explains that there’s a dip in the number of job openings, especially in the tech sector which Indians mostly look to specialise in, and there is sort of a freeze on “crazy” hikes witnessed during the Great Resignation scenario.

He pointed out that recessions (which reports say can happen earlier than expected) typically see unemployment rates inch upwards and the number of job openings being lower. The current unemployment rate in the US is 3.6 percent and has been on a downward/flat trajectory.

When asked about the mass layoffs at big tech companies like Microsoft and Meta, Mehra said there may not be as many opportunities at tech giants in the Silicon Valley probably, but there are other relatively smaller companies that would willingly hire Indian IT talent.

Athena Education is of the view that it’s still too soon to claim that there are fewer opportunities. “There remains a huge shortage in skilled labour in the US, especially among STEM majors. Big tech companies could be laying off, but there are several smaller boutique firms and startups that are looking for a diverse workforce,” co-founder Agrawal said.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM