By Bloomberg Jun 10, 2022 7:47:01 PM IST (Updated)

Listen to the Article(6 Minutes)

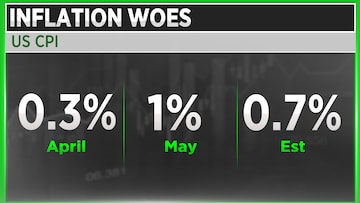

Inflation hit a fresh 40-year high in May in a broad advance, raising prospects that Federal Reserve will keep hiking interest rates aggressively for longer.

| Index | Current Value | Movement |

| Dow Jones | -743.30 | -2.3% |

| Nasdaq | -365.84 | -3.1% |

| S&P | -104.94 | -2.61% |

The so-called core CPI, which strips out the more volatile food and energy components, rose 0.6 percent from the prior month and 6 percent from a year ago, also above forecasts.

The figures reinforce that inflation is still heated by many measures, and that the US Fed — which has committed to half-point hikes at each of its next two meetings, starting next week — will have to maintain that aggressive stance through its September gathering. Record fuel prices and geopolitical factors threaten to keep inflation high in the coming months, suggesting the Fed will have to pump the brakes on the economy for longer.

Treasury yields jumped, stock futures fell and the dollar rose after the report.

"In the case of the US the most important news on monetary policy this year happened at the very start of the year when the Fed brought balancesheet contraction up the agenda in terms of time. So now it is a double whammy of monetary tightening, higher rates, Fed balancesheet contraction," Chris Wood, Global Head - Equities — at Jefferies, said.

Wood said there was political pressure on the central bank to turn more hawkish. "Half the reason the Fed did such a dramatic u-turn and has suddenly started talking so hawkish is because in Washington there was pressure from the moderate part of the Democratic Party on the Biden administration for the Fed to be seeing to be doing something about inflation. For the first time in more than 40 years we now have pressure on the American central bank from the executive and arms of government for the Fed to tighten," he said.

"Probably the most bearish looking signal we have right now is that there has been a very significant decline in US consumer confidence, more than I would have thought given that there is still high wage gains in America. So the US consumer confidence has weakened dramatically and you wonder if that is linked not only to rising prices but also people being hit by the stock market," he added.

| Currency | Price | Change | %Change |

|---|