The Reserve Bank of India's three-day Monetary Policy Committee commenced yesterday, December 5. After three back-to-back 50 basis points hike in interest rates, the Governor Shaktikanta Das-headed MPC is likely to opt for a lower rate increase of 25-35 bps in lending rates at its coming monetary policy review on Wednesday amid retail inflation showing signs of moderation and the need to push growth, according to experts.

The central bank will announce the outcome of the policy meeting on December 7.

The US Fed's hinting of a lower rate hike of 50 basis is very likely to affect RBI's decision. On the domestic front, retail inflation dropped to 6.77 percent in October from 7.41 percent in the preceding month, mainly due to easing prices in the food basket. However, it remained above RBI's comfort level for the 10th month in a row. The Consumer Price Index or CPI-based retail inflation has remained above the six percent target since January this year.

The rate-setting panel has raised the benchmark interest rate by a total of 190 bps so far in 2022. Morgan Stanley Chief Asia Economist Chetan Ahya had earlier told CNBC-TV18 that he expects the RBI to make a small rate cut by the end of 2023. He believes that 90 percent of Asian economies will have inflation within their central banks' comfort zone by mid-2023.

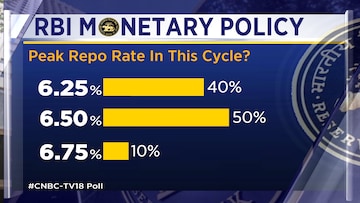

"We can look at 6.5 percent as the terminal repo rate by March. It will be two increases of 25-35 bps (each). There is no need for an aggressive 50 bps as inflation has started to slow down," Madan Sabnavis, Chief Economist at Bank of Baroda had told CNBCTV18.com.

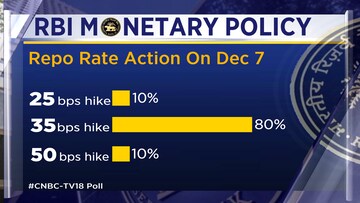

According to a poll by Reuters, the RBI is expected to raise interest rates by 35 basis points to 6.2 percent in December. A strong two-thirds majority said it was still too soon for the central bank to take its eye off inflation, which slowed to 6.8 percent in October having stayed above the upper end of the RBI's 2-6 percent tolerance band all year.

Thirty-three, or more than 60 percent, of the 52 economists polled by Reuters between November 22-30 said the RBI would raise its key repo rate by 35 basis points to 6.2 percent at its December 5-7 policy meeting.

Eleven said it would continue hiking by 50 basis points, while another eight respondents said 25 bps.

"A 50 bps hike would be too aggressive given that inflation has started showing signs of moderation and is progressing in line with the RBI's projections," Reuters mentioned, quoting Sakshi Gupta, the principal India economist at HDFC.

"The terminal rate in this cycle is expected to be 6.5 percent and the path to this is likely to be split between two rate hikes — 35 bps in December and then 25 bps in February."

With inflation expected to remain above the four percent midpoint of the RBI's target for the next two years, rates are set to go a bit higher still, with most economists seeing an upside risk to their forecasts.

The RBI also has to consider the potential pressure on the rupee if it falls behind expected increases in US rates.

“A lot of the discussions, not just globally but also in India is around a lot of coincident indicators like labour market, services, inflation being sticky – we know for a fact that in a business cycle, the slowdown starts with the housing and the industrial sector, gradually slips through into the labour market and with a lag is going to show up into wages and services inflation,” Sonal Varma, Managing Director & Chief Economist- India And Asia Ex-Japan at Nomura, told CNBC-TV18.

Despite poll medians showing the repo rate topping out at 6.5 percent by end-March, there was no consensus among economists over the RBI's final rate move in this cycle.

Economists were evenly split between no increase and a hike of 25 bps at the February meeting, with 44 of 52 expecting those outcomes. Among the rest, five predicted a 35 bps hike, and there were lone forecasts for 10 bps, 15 bps and 40 bps.

The survey also showed expectations that inflation would average 6.7 percent for the fiscal year ending March 31, and then fall to 5.2 percent in fiscal 2023-24.

Radhika Rao, senior economist at DBS Bank, told Reuters that a sharp run-up in commodity prices, supply-side shocks, resilience in domestic demand engines, and a prolonged global tightening cycle that would put pressure on the rupee was risks "that might convince the RBI to consider extending its rate hike cycle."

Gross domestic product (GDP) growth for July-September was reported at 6.3 percent, matching the RBI's own forecasts.

More than 70 percent of economists, 20 of 28, who answered an additional question in the poll, taken before the GDP release, said it was still too early for the RBI to shift its focus from inflation to growth.

Economists who answered a separate question pegged India's potential economic growth rate for the next 2-3 years at 6-7 percent. They forecast the annual growth rate to average 6.8 percent and 6.2 percent this fiscal year and next, respectively.

With inputs from Reuters

(Edited by : Asmita Pant)

First Published: Dec 1, 2022 12:55 PM IST