The RBI's Monetary Policy Committee began a three-day meeting on Wednesday as central banks around the globe face the Herculean task of taming sticky consumer inflation without causing an economic slowdown. Economists expect the central bank's top brass — responsible for changes to key interest rates — to announce an increase in the repo rate.

Economists, policymakers, investors and the general public will look out for RBI Governor Shaktikanta Das's post-policy remarks closely for the central bank's assessment of the state of the economy and clues on the future course of rate revisions.

The policy review comes at a time when major central banks are staring at warnings of a global recession from the IMF and the World Bank.

What to expect

Economists in a CNBC-TV18 poll expect the RBI to announce a hike of 50 basis points in the repo rate on September 30.

The repo rate currently stands at a pre-pandemic level of 5.4 percent, and a 50-bps hike on Friday will take it to 5.9 percent.

Here are key factors that warrant an increase in the RBI's upcoming policy:

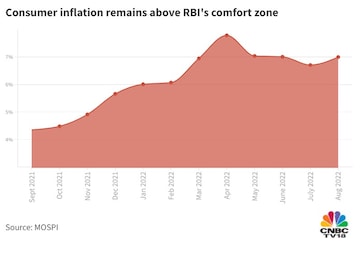

The inflation rate-targeting MPC aims to keep inflation within two percent around its target of four percent.

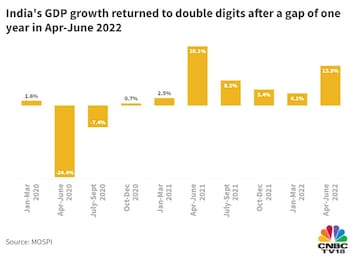

India's GDP expanded 13.5 percent in the April-June period compared with the corresponding three months a year ago. The growth rate, however, fell short of expectations of 15 percent by economists polled by CNBC-TV18.

Some economists even expect the central bank to increase the key rates at a faster pace than envisaged earlier.

In the last scheduled review, in August, the RBI announced a hike in the repo rate by 50 basis points — taking the total increases in 2022 to 140 basis points spread over three revisions. It voted unanimously to raise the repo rate in the August review.

The MPC said it is focused on withdrawal of its "accommodative" policy stance — which means the central bank is prepared to expand the supply of money to aid economic growth — while retaining its GDP and inflation forecasts for the year ending March 2023. It said the future course of hikes will depend upon data.

First Published: Sept 28, 2022 3:25 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM