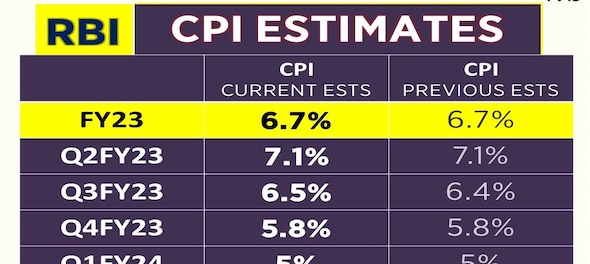

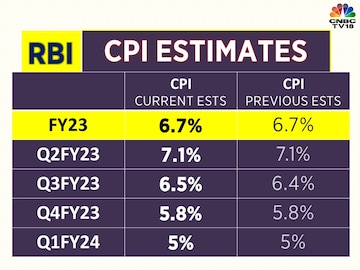

The Reserve Bank of India (RBI) has retained its retail inflation projection at 6.7 percent for the financial year ending March 2023. While there is no change in the estimate, governor Shaktikanta Das warned of a possible rise in prices of wheat and vegetables.

"Inflation is hovering around 7 percent and the RBI expects it to remain elevated. It should average around 6 percent in the second half of the year," Das said.

These are the RBI's estimates for retail inflation for the rest of the financial year

The Consumer Price Index (CPI), which RBI factors in while fixing its benchmark rate, stood at 7 percent in August. Retail inflation has been ruling above the RBI's comfort level of 6 percent since January this year.

The governor hopes improving supply conditions and softening commodity prices (including crude oil) will help in easing the pressure of rising prices. However, he warned that wheat prices may continue to rise because of reduced sowing in the Kharif season.

Earlier this year, the government had banned the export of wheat to curb prices from rising. What's worse, the unseasonal rains caused by the delay in monsoon withdrawal may push up vegetable prices. Meanwhile, the Narendra Modi administration has decided to extend the programme to provide foodgrains and pulses for the country's poor by another three months.

While the recent fall in crude oil prices, which saw their biggest quarterly drop in over 2 years, may provide some relief, the RBI may not be able to let its guard down. Reducing the excess money in the economy through hikes in interest rates is one way to bring demand, and therefore, prices down.

The central bank raised the benchmark lending rate by 50 basis points to 5.90 percent and has hinted at another one in December. With the latest hike, the repo rate, or the short-term lending rate at which banks borrow from the central bank is now close to 6 percent.

Inflation risks also emerge from the weakness in the currency, especially in countries like India, which is a net importer of key commodities like crude oil, electronics and a lot more, which have a domino effect on other goods and services too. The cost of the Indian crude basket is down is still $100 a barrel and that's quite high.

RBI has slashed the real GDP growth estimate to 7 percent from an earlier forecast of 7.2 percent for FY'23.

First Published: Sept 30, 2022 10:19 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha Election 2024: Gurugram gears up for crucial polls amidst economic boom and civic woes

Apr 24, 2024 11:41 PM

Lok Sabha Election 2024: Crucial seats up for grabs as Rajasthan, Maharashtra, Bihar gear up for 2nd phase of polls

Apr 24, 2024 11:40 PM