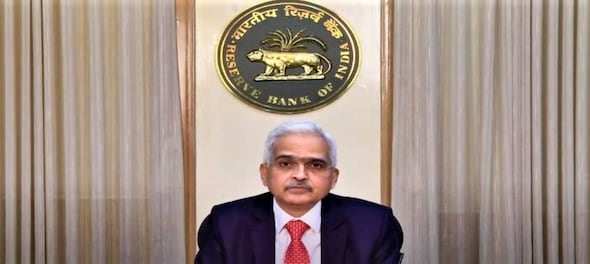

In its attempt to curb inflation, the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) has decided to increase the repo rate by 50 basis points (bps) to 5.40 percent. The decision, announced by Governor Shaktikanta Das, was taken in committees in its bi-monthly policy meeting.

Read the full text below:

S

tatement on Developmental and Regulatory Policies

This Statement sets out various developmental and regulatory policy measures relating to (i) Regulation and Supervision; (ii) Financial Markets; and (iii) Payment and Settlement systems.

I. Regulation and Supervision

1. Master Direction on Managing Risks and Code of Conduct in

Outsourcing of Financial Services

Regulated Entities (REs) are increasingly using outsourcing as a means for

reducing costs as well as for availing expertise not available internally. Although outsourcing of a permissible activity is an operational decision of REs, it exposes REs to various risks.

The Reserve Bank of India has, from time to time, issued several guidelines/ directions on managing risks in outsourcing of financial services to Scheduled Commercial Banks (excluding Regional Rural Banks (RRBs)), Non-Banking Finance Companies (NBFCs), Housing Finance Companies (HFCs) and co-operative banks.

With a view to update and harmonize the extant guidelines, adopt and incorporate global best practices as also enable REs to have all current instructions on outsourcing of financial services at one place for reference, the Reserve Bank proposes to issue draft Reserve Bank of India (Managing Risks and Code of Conduct in Outsourcing of Financial Services) Directions, 2022, for public comments shortly. The scope of these Directions is being expanded to also include RRBs, Local Area Banks (LABs), All India Financial Institutions, Credit Information Companies, and non-scheduled Payments Banks.

2. Inclusion of Credit Information Companies (CICs) under the Reserve

Bank - Integrated Ombudsman Scheme (RB-IOS) 2021 and Extending the

Internal Ombudsman (IO) Mechanism

The Reserve Bank-Integrated Ombudsman Scheme (RB-IOS) 2021, covers

Regulated Entities (REs) such as scheduled commercial banks including urban

cooperative banks, non-banking financial companies (NBFCs) and non-scheduled primary co-operative banks with a deposit size of ₹50 crore and above.

In order to make the RB-IOS more broad based, it has been decided to bring Credit Information Companies (CICs) also under the ambit of RB-IOS 2021. This will provide a cost free alternate redress mechanism to customers of REs for grievances against CICs. Further, with a view to strengthen the internal grievance redress of the CICs and to make it more efficient, it has also been decided to bring the CICs under the Internal Ombudsman (IO) framework.

II. Financial Markets

3. Standalone Primary Dealers (SPDs) – expansion in scope of permitted

activities

At present, Standalone Primary Dealers (SPDs) are permitted to undertake

foreign currency business for limited purposes. With a view to strengthen the role of SPDs as market makers, on a par with banks operating primary dealer business, it is proposed to enable SPDs to offer all foreign exchange market-making facilities as currently permitted to Category-I Authorised Dealers, subject to prudential guidelines.

This measure would give forex customers a broader spectrum of market-makers in managing their currency risk, thereby adding breadth to the forex market in India. Wider market presence would improve the ability of SPDs to provide support to the primary issuance and secondary market activities in government securities, which would continue to be the major focus of primary dealer activities. Regulations in this regard would be issued separately.

4. Permitting Standalone Primary Dealers to Deal in offshore Foreign

Currency Settled Overnight Indexed Swap Market

Banks in India were permitted, in February 2022, to undertake transactions in theoffshore Foreign Currency Settled Overnight Indexed Swap (FCS-OIS) market with non-residents and other market makers with a view to removing the segmentation between onshore and offshore OIS markets and improving the efficiency of price discovery.

Standalone Primary Dealers (SPDs) are also market-makers, like banks, in the onshore OIS market. It has now been decided that SPDs authorized under section 10(1) of FEMA,1999 will also be permitted to undertake FCS-OIS transactions directly with non-residents and other market-makers. Necessary directions will be issued shortly.

5. Committee on MIBOR Benchmark

The Mumbai Interbank Outright Rate (MIBOR) based overnight indexed swap

(OIS) contracts are the most widely used interest rate derivatives (IRDs) in the

onshore market.

The usage of MIBOR based derivative contracts has increased with steps taken by the Reserve Bank to diversify the participant base and facilitate the introduction of new IRD instruments. At the same time, the MIBOR benchmark rate, calculated based on call money deals executed on the NDS-call platform in the first hour after market opening, is based on a narrow window of transactions.

Internationally, there has been a shift to alternate benchmark rates with wider

participant bases (beyond banks) and higher liquidity. Amidst these developments, it is proposed to set up a committee to undertake an in-depth examination of the issues, including the need for transition to an alternate benchmark, and suggest the most appropriate way forward.

III. Payment and Settlement Systems

6. Enabling Bharat Bill Payment System (BBPS) to Process Cross-Border

Inbound Bill Payments

Bharat Bill Payment System (BBPS), owned and operated by NPCI Bharat BillPayLtd. (NBBL), has transformed the bill payment experience in the country. BBPS offers an interoperable platform for standardised bill payment experience, centralised customer grievance redress mechanism, uniform customer convenience fee, etc.

Over 20,000 billers have been onboarded on the system and more than eight crore transactions are processed on a monthly basis. BBPS is currently accessible only for residents in India.

To facilitate Non-Resident Indians (NRIs) undertake utility, education and other bill payments on behalf of their families in India, it is proposed to enable BBPS to accept cross-border inward payments. This will also benefit payment of bills of any biller onboarded on the BBPS platform in an interoperable manner. Necessary instructions will be issued shortly.

First Published: Aug 5, 2022 2:04 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Andhra Pradesh Lok Sabha elections: A look at YSRCP candidates

Apr 25, 2024 6:54 PM

Lok Sabha elections 2024: Banks and schools to remain closed in these cities for phase 2 voting

Apr 25, 2024 5:33 PM

Andhra Pradesh Lok Sabha elections: Seats, schedule, NDA candidates and more

Apr 25, 2024 5:16 PM