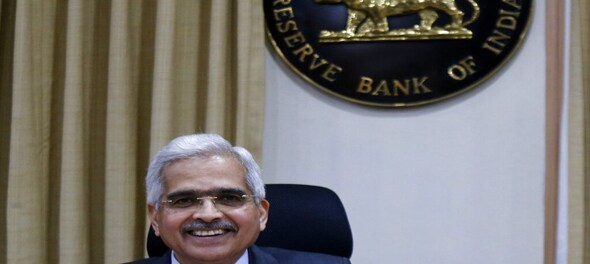

Reserve Bank of India’s (RBI) Governor Shaktikanta Das said on Wednesday that the appreciation of the US dollar that precipitated large-scale depreciation of all major currencies, including the Indian rupee (INR), had drawn wide attention. He said it was important to make an objective assessment of the movement of the rupee in the context of global and domestic macroeconomic developments and financial market conditions.

He said that through this episode of the US dollar appreciation, the rupee’s movements have been the least disruptive relative to the peers.

“The rupee has appreciated against all other major currencies except a few (barring the Swiss franc, the Canadian dollar, the Singapore dollar, the Russian ruble, etc.),” he said.

On a financial year basis, from April to October, the rupee has appreciated by 3.2 percent in real terms, even as several major currencies have depreciated.

"The story of INR has been one of India’s resilience and stability," Shaktikanta Das said.

He believes once the US Fed tightening is over, the tide will turn, capital flows to India will improve, and external financing conditions will ease.

“In this complex world with both push and pull factors at play, the INR - which is market-determined - should be allowed to find its level, and that is precisely what RBI is trying to achieve,” he said.

Also Read: View | Not just China plus one, the world needs a dollar plus two, if not three, strategy

Finance Minister Nirmala Sitharaman had also reiterated the fact that the RBI was not intervening to fix the value of the rupee but was only checking rupee volatility. "So, containing the volatility is the only exercise RBI is involved in. And I have said this before, the rupee will find its own level," the FM said, adding that she is not looking at it as the rupee sliding but rather as the dollar strengthening.

Meanwhile, RBI raised the benchmark lending rate by 35 basis points to 6.25 percent as expected, and the RBI Governor Shaktikanta Das' reiteration that there would be no let up in bringing down inflation raised the likelihood of another rate hike in the next Monetary Policy Committee (MPC) meeting.

This was the fifth consecutive rate hike after a 40 basis points increase in May and 50 basis points hike each in June, August, and September. The RBI has raised the benchmark rate by 2.25 percent since May this year.

The Consumer Price Index (CPI) based inflation, which RBI factors in while fixing its benchmark rate, stood at 6.7 percent in October. Retail inflation has been ruling above the RBI's comfort level of 6 percent since January this year.

The RBI slashed its GDP growth forecast to 6.8 percent from an earlier estimate of 7 percent for the current fiscal year.

First Published: Dec 7, 2022 12:03 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Every student suicide pains me, I will try better: BJP Kota MP Om Birla

Apr 16, 2024 2:19 PM

Bihar Lok Sabha elections 2024: Schedule, total seats, Congress candidates and more

Apr 16, 2024 1:02 PM

Lok Sabha polls: BJP drops Som Parkash, fields Abhijit Das against Mamata's nephew

Apr 16, 2024 12:49 PM