Moody’s Investors Service has lowered 2022 real gross domestic product (GDP) growth projections to 7.0 percent from 7.7 percent. It said that it is expecting growth to decelerate to 4.8 percent in 2023 and then to rise to around 6.4 percent in 2024.

"The downward revision assumes higher inflation, high interest rates and slowing global growth will dampen economic momentum by more than we had previously expected," Moody's said in its report titled “Global Macro Outlook 2023-24: Global economy faces a reckoning over inflation, geopolitics and policy trade-offs”.

"The weakening of the rupee and high oil prices continue to exert upward pressures on inflation, which has remained above the Reserve Bank of India's (RBI) 4 percent -/+ 2 target inflation range for much of this year. Annual headline CPI inflation increased to 7.5 percent in September after dipping below 7 percent in July. Wholesale price inflation, however, has declined for four straight months, from a peak of 16.6 percent in May to 10.7 percent in September," it said.

From May to September, the RBI raised the repo rate a cumulative 190 bps to 5.9 percent in an effort to contain inflation risks.

Moody's said it is expecting the RBI to raise the repo rate by another 50 bps or so as part of its objective to anchor inflation expectations and support the exchange rate. Eventually, the RBI will likely shift from inflation management to growth considerations, provided that the rate increases have the desired effect of taming inflationary pressures.

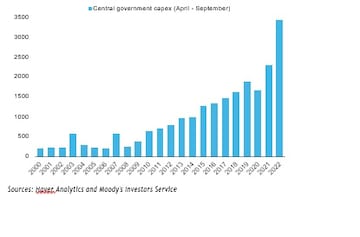

Underlying growth dynamics are fundamentally strong, boosted by a rebound in services activity. Government capital expenditure and manufacturing capacity utilization have also improved. September exports are down from the peak in March, but they are still around 30 percent above the pre-pandemic level. Nonfood credit growth shows solid momentum, Moody's said.

The private sector, having deleveraged after the RBI's Asset Quality Review in 2015, is now well-positioned to increase capex spending. Also, the Production Linked Incentive Scheme to attract investment in 14 key manufacturing sectors is showing results. While these domestic strengths will continue to support the domestic growth narrative, global financial tightening and slowing external demand will pose downward pressure on growth in 2023

On China’s real GDP, it said that it expects it to grow 3.0 percent this year, down from our 3.5 percent forecast in August, with growth projected to pick up to around 4.0 percent in both 2023 and 2024.

"Our forecasts reflect the impact of COVID-19 control measures, which are weighing on consumption. In addition, the property sector downturn will inflict losses on households, developers, bank and non-bank lenders, and local government finances," it mentioned.

On global economy, Moody's said that it is on the verge of a downturn amid extraordinarily high levels of uncertainty amid persistent inflation, monetary policy tightening, fiscal challenges, geopolitical shifts and financial market volatility.

"Global growth will slow in 2023 and remain sluggish in 2024. Still, a period of relative stability could emerge by 2024 if governments and central banks manage to navigate their economies through the current challenges," it added

First Published: Nov 11, 2022 12:20 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: BJP's bid for breakthrough in Kerala is an uphill battle, say experts

Apr 23, 2024 9:53 PM

2024 Lok Sabha Elections | PM's Rajasthan speech — has it anything to do with the post-poll mood of the first phase

Apr 23, 2024 3:45 PM

It's KGF 2024 and here's a look at the key characters in Karnataka

Apr 23, 2024 3:17 PM

JP Morgan: Nifty may test 25,000 if BJP wins in 2024 Lok Sabha elections

Apr 23, 2024 2:23 PM