Sri Lanka's crisis, pushed by the island nation's high debt levels, soaring inflation and food shortages, has become a kind of a cautionary tale for a number of debt-laden countries that could be as vulnerable. Veteran banker Uday Kotak on July 12 flagged currency risks, especially for emerging markets as the euro is now at parity with the safe-haven dollar, hitting a fresh 20-year low.

In a tweet, Kotak Mahindra Bank CEO said, "€ at 1:1 to $.Gold, crypto, pound and yen crumble. The supremacy of US currency. Emerging market countries need to be alert. Some of the biggest risks emanate from currencies and can destroy some countries. Look thy neighbours Lanka and Pakistan."

The gains in the greenback, measured by the dollar index, comes amid the prospect of further toughening of stance by central banks, resurfacing COVID-19 outbreaks in China, and Europe's energy shortages spooking investors amid the ongoing Russia-Ukraine war.

Indian rupee and external debt situation

The ongoing fall in the Indian Rupee vis-a-vis the dollar has raised similar worries amid a widening trade deficit coupled with high external debt.

India's trade deficit widened to $25.63 billion in June, pushed by oil and coal imports, according to data from the Ministry of Commerce and Industry. For the first quarter of the current financial year, the trade deficit has widened to $70.25 billion due to high imports.

On the external debt front, India needs to repay around $267 billion out of a total of $621 billion in less than a year. The $267-billion repayment is equivalent to about 44 percent of India's current foreign exchange reserves.

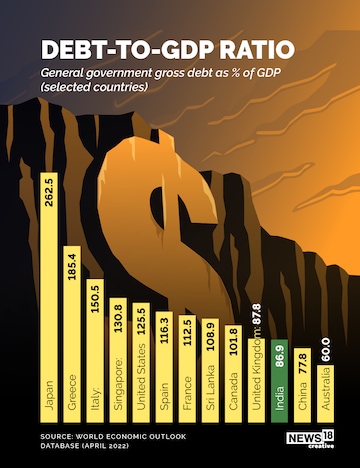

The Centre has tried to soothe nerves about India's massive $621-billion external debt, saying its share is just $130.8 billion, or 21 percent of the total liability, and of which just $7.7 billion needs to be repaid in less than a year, as per an ET report. Nonetheless, the debt of some Indian states is at unhealthy levels and the RBI and economists have flagged this time and again.

Overall, India's gross public debt stands at 86.9 percent of the GDP, which is high but comparatively better than developed economies such as the US, France, Canada, the UK and others. Brazil, an emerging market economy, has 91.9 percent gross public debt.

Pakistan's total public debt stood at $215 billion at the end of March 2022, as per the country's Economic Survey 2021-22.

What do experts say?

On its part, India has taken measures to put an additional way for invoicing, payment, and settlement of exports and imports in the Indian rupee. The policy could go a long way in pushing the rupee mechanism.

India's high inflation is "not so problematic," said Vinay Khattar, Executive VP and Head of Research at Edelweiss Broking, while reckoning that significant pressure is building up globally because of high inflation in the US.

"As far as India is concerned, our own story is not so problematic, though our inflation is on the higher side. But a chunk of that is imported inflation driven significantly by fuel prices, which are a large factor of the Russia-Ukraine problem," Khattar told CNBC-TV18.

Vinod Nair, Head of Research at Geojit Financial Services, said, "Interest rate hike fears are back in focus in the global markets... Inflationary pressure along with strong US jobs data would keep the Fed on the path of aggressive rate hikes... Demand concerns amid a rebound in coronavirus cases in China compelled crude oil to trade lower."

—With inputs from agencies

(Edited by : Shoma Bhattacharjee)

First Published: Jul 12, 2022 7:12 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: From Wayanad to Shivamogga, key battles in the second phase

Apr 25, 2024 2:01 PM

EC probes allegations of MCC violation by Modi, Rahul; seeks response by April 29

Apr 25, 2024 1:32 PM

LS polls phase 2: Rahul Gandhi, Shashi Tharoor in fray; Hema Malini, Om Birla eyeing hat-trick

Apr 25, 2024 12:19 PM

UP constituencies to witness three-cornered fight in second phase tomorrow

Apr 25, 2024 10:47 AM